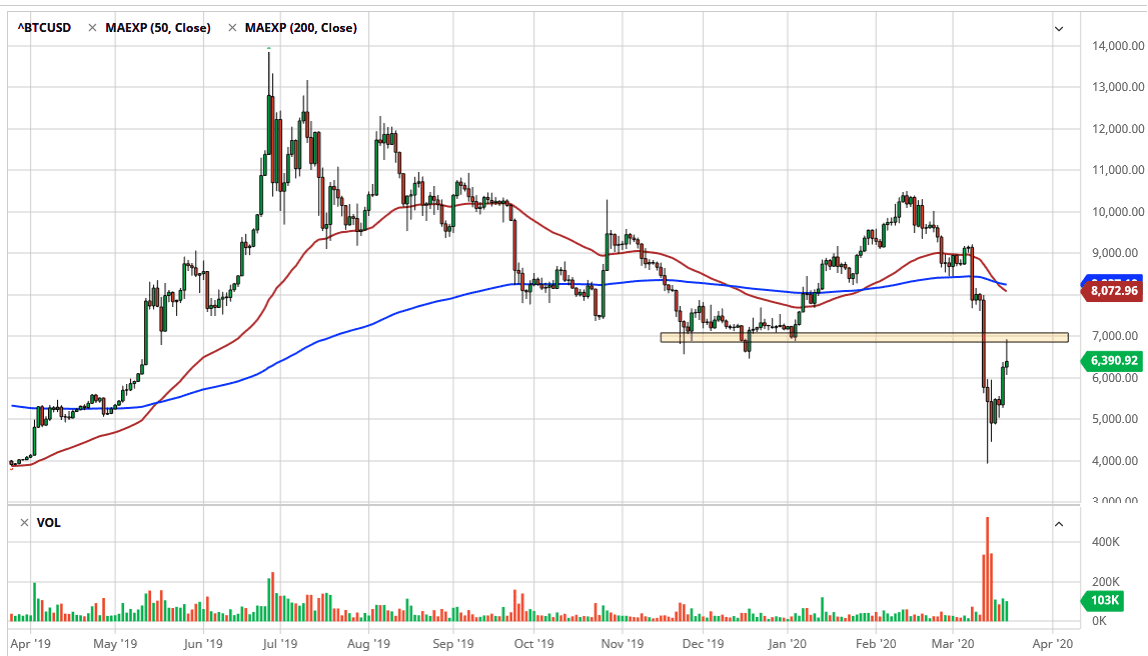

Bitcoin initially surged during the opening hours on Friday, but as I had been talking about previously, the first major resistance barrier was going to be at the $7000 level. By the end of the trading session, the market had pulled back from there rather significantly to form a bit of a shooting star. That shooting star of course is a very bearish sign and if we break down below the bottom of it, basically the $6000 level, it’s likely that the market will roll over and continue to go lower, with an eye on the $5000 level initially, and then possibly even as low as $4000 again.

That being said, the market can break above the $7000 level it would show another attempt and a lot of resiliency by the bullish traders out there to take out the resistance and aim towards the $8000 handle. The biggest mistake that a lot of traders are making right now is that they forget that Bitcoin is being traded against the US dollar, or another currency. They don’t look at these charts as currency pairs, which is exactly what they are. The strongest currency in the world right now is by far the US dollar, so that is working against the value of the Bitcoin market in general. If you look at other charts such as the BTC/EUR chart, BTC/GBP, and so on, you will see that Bitcoin is doing much better on the whole.

That being said, there doesn’t seem to be any real sign of the US dollar losing a whole lot of strength in the short term. Because of this, I think this market will still face of headwinds, and if you were paying attention earlier this week you know that I had said that basically $8000 would be about as far as this market was likely to go, at least in the time being. I still think that’s true, but as we head into the weekend and a lack of volume, just about anything will be possible over the next couple of days. I would say this though: if the market does spike over the weekend, I will be more than willing to sell into that as it will almost certainly be faded. All things being equal, I think the Bitcoin market is going to remain a bit soft for a while, as speculative betting is drying up everywhere.