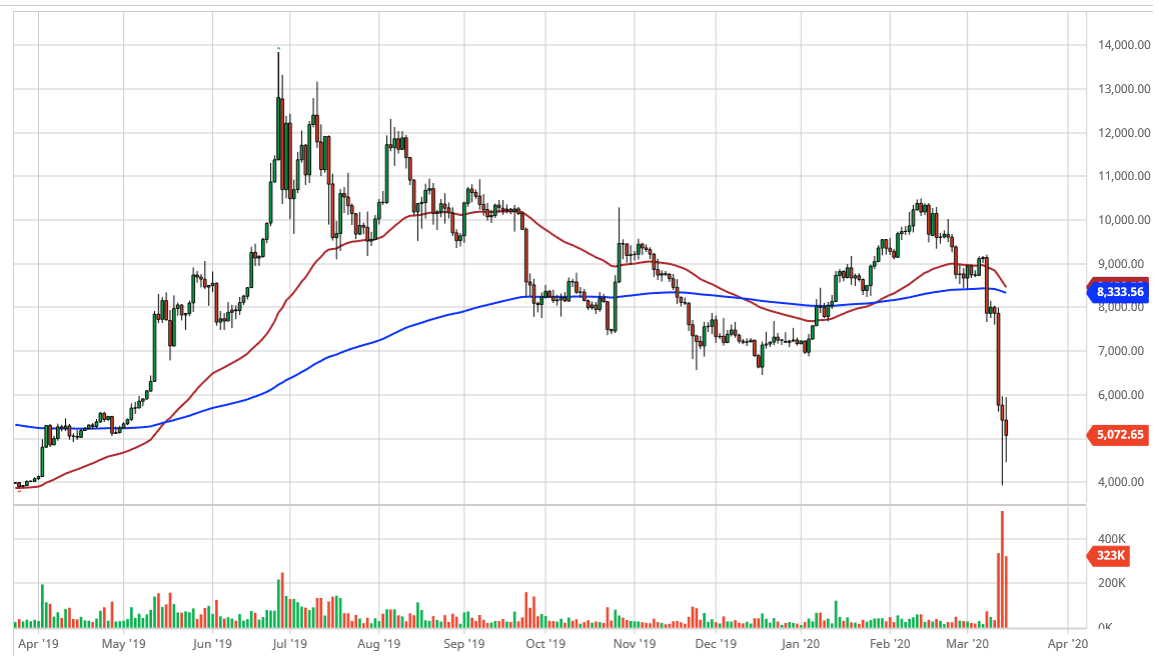

Looking at the price action on Monday, I believe that Bitcoin is still going to see a lot of violent swings back and forth, but I also believe that we are in the process of trying to form some type of base in bitcoin. This makes sense, because it has lost as much as half of its value in the last couple of days. I believe at this point we are trying to form the base in Bitcoin around the $4000 level, perhaps even the $5000 level as both of those are large, round, psychologically significant figures. After all, markets can’t go up or down forever so the best thing that true believers can hope for now is that we start to stabilize. Stabilizing the Bitcoin market opens up the possibility of a recovery like we have just had, where the market go sideways for a while and then eventually build up more pressure.

One thing is for sure, this has been a brutal selloff and at this point it’s going to take quite a bit for traders to get involved and start buying with any type of faith or conviction. After all, it’s hard to lose 50% of your investment in roughly 36 hours and add to that position. I suspect that there has been a lot of panic selling recently, and it probably has a lot to do with what we are seeing right now. The bounce from the $4000 level has been rather crucial and impressive, and the fact that we are sitting just above $5000 does suggest to me that there is going to be at least an attempt to try to hang on to some of the gains.

If the market were to turn around and break above the $6000 level, I would be very leery of that move because it would probably be a bit too erratic, just like the selling was. I would like to see this market break above the $6000 level after a couple of weeks of sideways action. Long gone are the days of Bitcoin gaining 15% a day on a regular basis, as there are more people involved in the market then there were back when that was common. Because of this, I believe that it simply sitting and waiting to see if we can get some stabilization is probably the best trade of all. Remember, sometimes being on the sidelines is the correct trade.