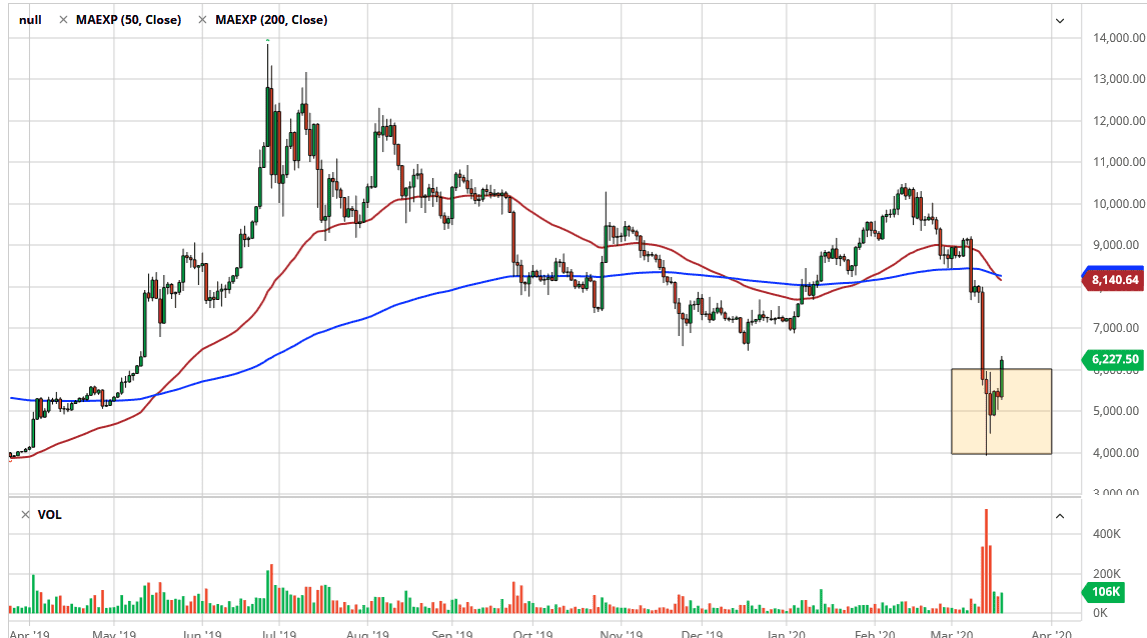

The Bitcoin market broke higher during trading on Thursday, clearing the $6000 level quite handily. This is a good sign, because we have broken above the hammer that formed after the massive selloff last week. If that’s going to be the case, I do believe that it is only a matter of time before the market reaches towards the $7000 level as I had anticipated in the last Bitcoin video. $7000 will offer a certain amount of psychological resistance but we could very well go beyond that in looking towards the $8000 level next.

I don’t necessarily think that Bitcoin is suddenly in a new bull market, I think it’s simply a recovery after selling off quite drastically. The relief rally can be profitable, but you need to be somewhat nimble to take advantage of that. I think at this point the area at the $8000 level could offer significant resistance, as the 50 day EMA is sitting just above there. Beyond that, we have seen the 50 day EMA close below the 200 day EMA over the last couple of sessions, which is a very bearish signal longer term. I don’t necessarily worry too much about that, but I do recognize that a lot of longer-term algorithms will.

I think the next couple of days will be somewhat positive, but I do also believe that the overall trend still remains soft at best. If we did break above the 200 day EMA, then it’s likely that we could go towards the $9000 level followed very quickly by the $10,000 level. Bitcoin markets have been an absolute mess recently, and although this has been a very strong bounce during the trading session, one would have to think that it is just that, a bounce. Looking at this chart, it appears that the market is going to look at the $5000 level with favor, as it should now offer not only significant psychological support, but also the potential of structural support.

Although I remain bearish of Bitcoin, I don’t necessarily think that the market is going to completely collapse. I think selling rallies continues to work from a longer-term standpoint, but I don’t necessarily think that we are going to slice right through the $4000 handle like it wasn’t there. At this point, look for value in the US dollar when it comes to trading this pair, but you also have to keep an open mind as Bitcoin tends to move back and forth rather rapidly.