The Bitcoin market has rallied slightly during the trading session on Tuesday, as the $5000 level has offered enough support to cause the market to pop a bit. At this point, the $5000 level will attract a lot of attention due to the fact that it is a large, round, psychologically significant figure, and an area that has been important previously. That being said, the market did break down towards the $4000 level before bouncing a bit and hanging out in this general vicinity.

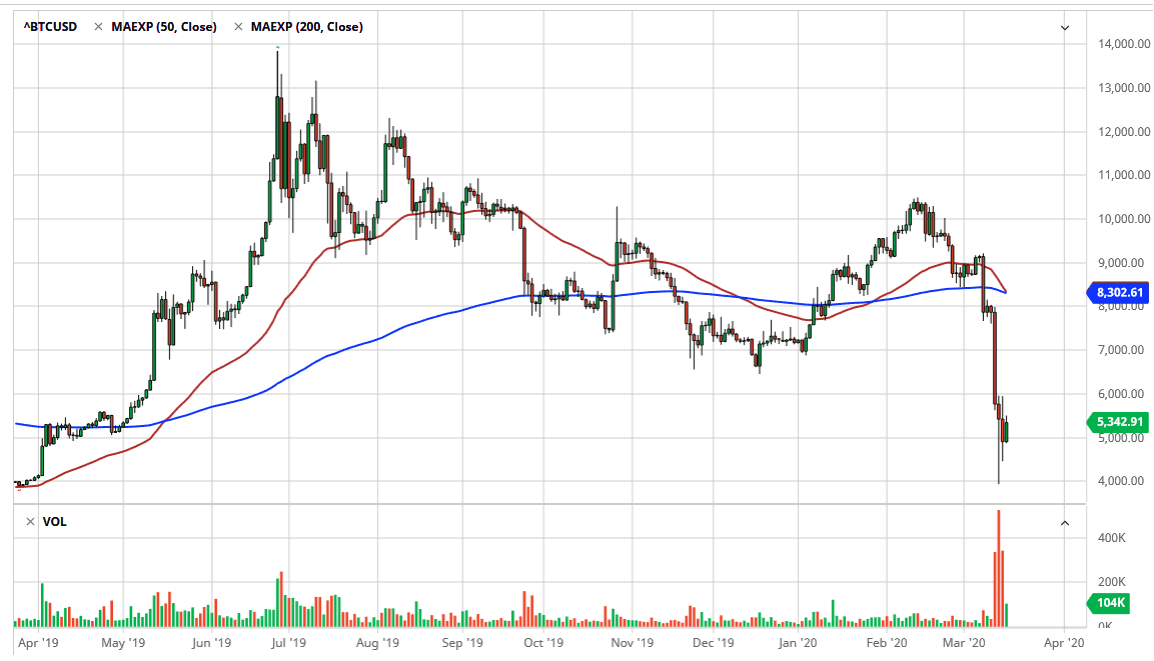

At this point, the market is stabilizing and that is probably the best thing that the bitcoin market could see happen. If this is going to be the case, it’s likely that eventually when we break above the short term consolidation, more money will come back into the marketplace. This would be a breakout above the $6000 level, which opens up a move to the $7000 level rather quickly, and then possibly the $8000 level. The $8000 level will cause a significant amount of resistance, not only based upon the previous break down, but the fact that the 50 and the 200 day EMA both are sitting just above there. In fact, they are getting ready to cross which is also a negative sign.

All things being equal, the market will probably continue to look at Bitcoin with a bit of skepticism though, as these massive selloff will continue to shake confidence. In a new market like Bitcoin, confidence is everything. Just take a look at what the stock market has done, as confidence has been shaken there, and it has significantly more history than the crypto markets do. That being so, short-term buying opportunity may present itself above the $6000 level. I do not anticipate that it will continue to go much further, and I believe that $8000 will bring in fresh selling, unless of course there is another rush to get money out of a place like China. That being said, there is also the alternate scenario where if you can break down below the $4000 level, the Bitcoin market could find itself testing the $3000 level rather rapidly. Either way, a bounce does make a bit of sense considering that we had sold off so rapidly in this market, and the selling pressure was a bit overdone. The more time the market spends sideways the more likely it is to be a positive sign.