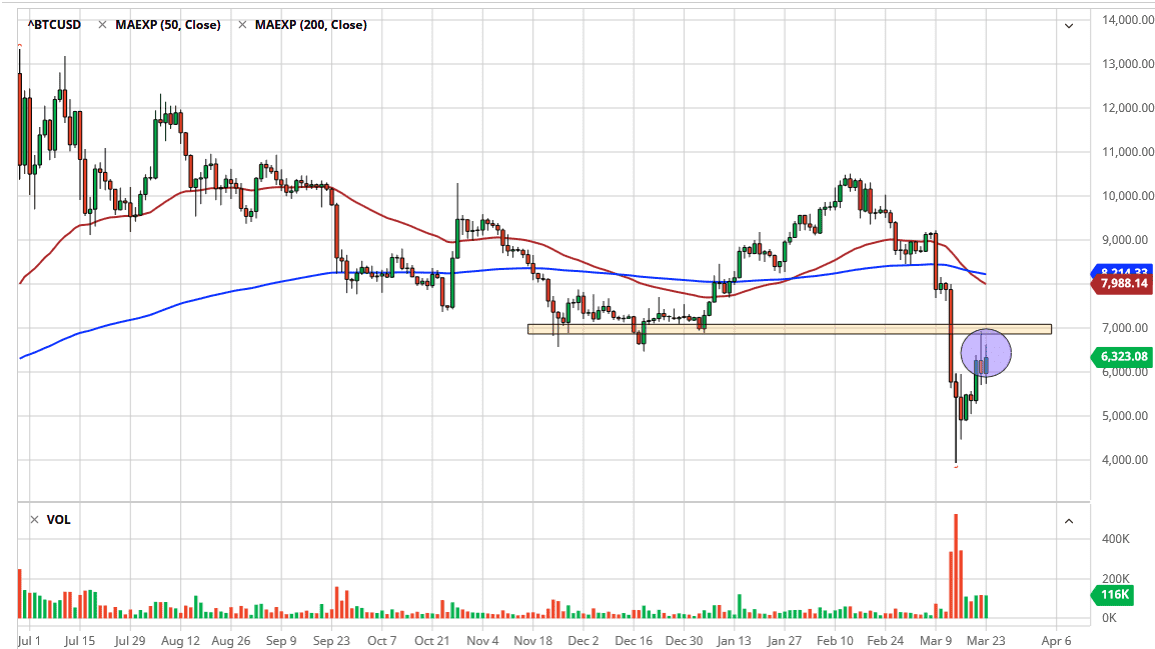

The Bitcoin market has been a little bit buoyant during the trading session on Monday, showing just how confused a lot of market participants are. You have seen this in several different assets, not just Bitcoin. If you been following my analysis recently, I suggested that if we broke above the $6000 level, we would go looking towards the $7000 next, possibly even $8000 given enough momentum. We ended up turning right back around at the $7000 level, but now find a bit of support in $36,000 level.

In a sense, Bitcoin has move right along with the stock market during the trading session, which has been all over the place due to the Federal Reserve talking about further quantitative easing, but Bitcoin has not been capitalizing on the suppose it weakness of fiat currencies as they can be printed out of thin air. This is because there is still a huge demand for the US dollar itself. This is because of the debt markets around the world, something that unfortunately, most crypto currency traders don’t truly understand. Liquidity is a major issue and the world’s currency is the US dollar. We can debate whether or not that’s going to be the case in 100 years, but clearly it will be next year. That being said, Bitcoin against the US dollar is going to suffer. In reality, if you choose to buy bitcoin you are probably going to be better off doing it in other currencies.

As long as there is a lot of debt out there, the US dollar is going to continue to be in demand. There is a massive deleveraging around the world right now, and although Bitcoin is a bit of a way to try to break away from the cycle, the reality is that it is but a small bit of currency from a global standpoint. In other words, you are trading in a very small and thin market when you are involved with Bitcoin. Nonetheless, in the short term if the market was to break down below the low of the Monday session, it’s very likely that we turn around and test the $5000 level. Alternately, if we were to break out above the $7000 level on a daily close, then it will be almost assured that we will go looking towards the $8000 level. Short-term trading is probably is about as good as it gets in this market right now.