Following the latest Bitcoin crash, eliminating hopes that this cryptocurrency possesses similar safe-haven attributes like gold, more downside cannot be ruled out. Unlike gold, price action failed to recover despite a spike in bullish momentum, which is starting to fade. Despite the crash, the hashrate spiked to an all-time high in anticipation of the May having event, the third in its history. It is likely to be followed by a crash due to the inability of mining equipment to remain profitable. Costly upgrades will be required, creating conditions for a breakdown in the BTC/USD after the having event, contradicting the previous two that led to fresh all-time highs.

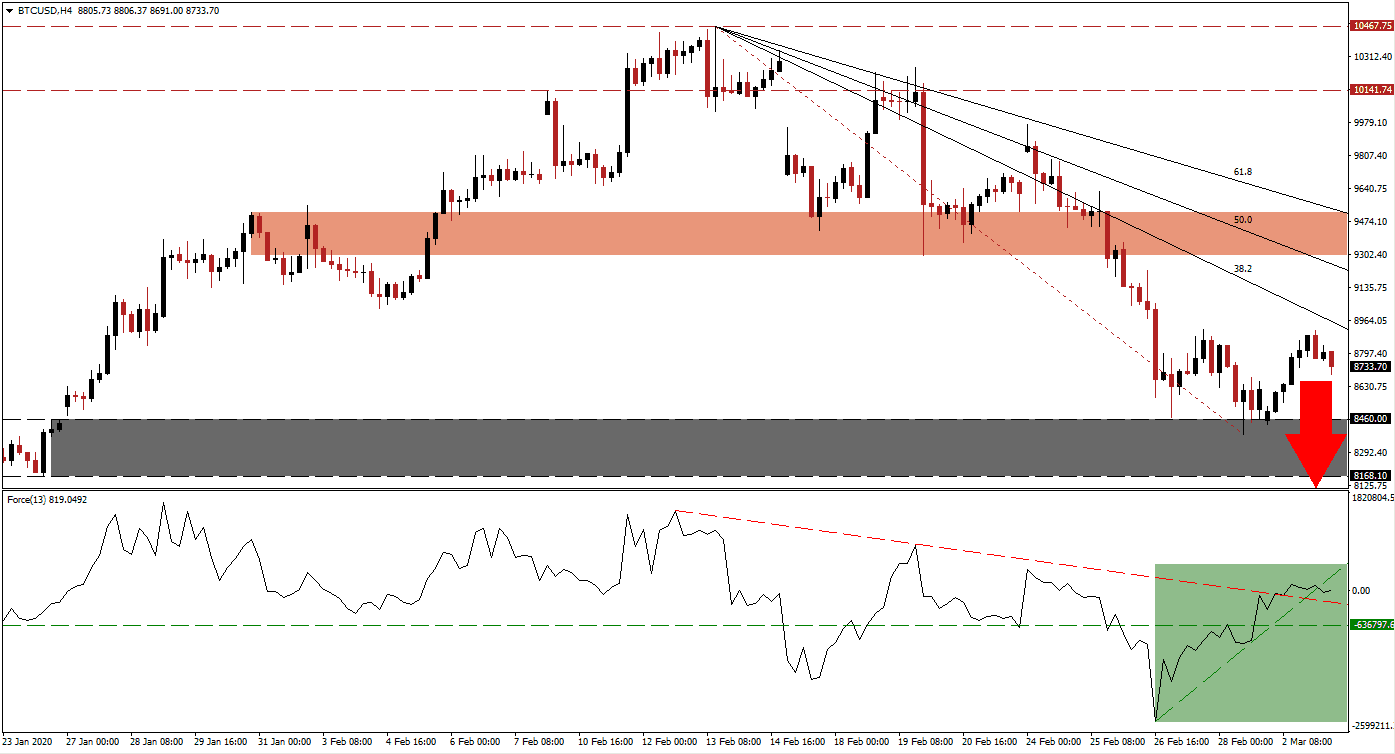

The Force Index, a next-generation technical indicator, was able to reverse off of a new 2020 low. Bullish momentum sufficed to convert its horizontal resistance level into support. An ascending support level emerged, pressuring the Force Index above its descending resistance level, as marked by the green rectangle. Bulls remain in charge of the BTC/USD, but conditions are deteriorating after this technical indicator moved below its ascending support level. An accelerated move into negative territory is expected to materialize, granting bears control of price action. You can learn more about the Force Index here.

Price action briefly dipped into its support zone located between 8,168.10 and 8,460.00, as marked by the grey rectangle. The BTC/USD bounced higher, failing to maintain its uptrend after a double top formation. This bearish chart pattern exercised downside pressure, warranting a redrawing of the Fibonacci Retracement Fan sequence. Bearish pressures are now expanding, inspired by the descending 38.2 Fibonacci Retracement Fan Resistance Level. The failed breakout may result in a more massive correction, likely to drag the majority of the cryptocurrency market lower.

Due to growing bearish momentum, the short-term resistance zone located between 9,296.60 and 9,517.74, as marked by the red rectangle, will be lowered to reflect developments in price action. The 61.8 Fibonacci Retracement Fan Resistance Level is on the verge of entering this zone, limiting upside potential for counter-trend rallies, and adding to breakdown pressures in the BTC/USD. Price action will face its next support zone between 7,382.50 and 7,629.02. More downside cannot be ruled out, but volatility is favored to increase over the next twelve weeks.

BTC/USD Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 8,775.00

Take Profit @ 7,385.00

Stop Loss @ 9,075.00

Downside Potential: 139,000 pips

Upside Risk: 30,000 pips

Risk/Reward Ratio: 4.63

In the event of a breakout in the Force Index above its ascending support level, currently acting as resistance, the BTC/USD is anticipated to push higher from current levels. As a result of the dominant technical scenario which carries a bearish bias, coupled with uncertain fundamental developments related to the upcoming having event, the upside potential is limited to its 61.8 Fibonacci Retracement Fan Resistance Level.

BTC/USD Technical Trading Set-Up - Price Action Reversal Scenario

- Long Entry @ 9,135.00

Take Profit @ 9,500.00

Stop Loss @ 8,985.00

Upside Potential: 36,500 pips

Downside Risk: 15,000 pips

Risk/Reward Ratio: 2.43