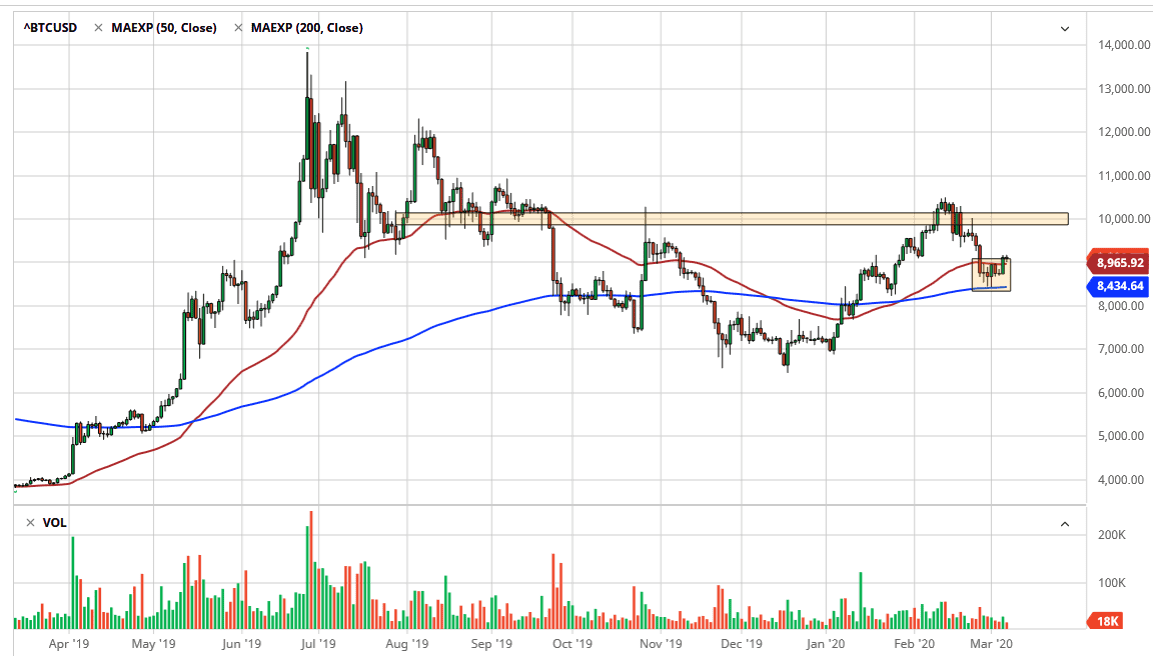

Bitcoin markets have done very little during the trading session on Friday after rallying on Thursday. They are sitting just above the 50 day EMA, a technical indicator that has been crucial more than once. If you remember my analysis from a few days ago, I had suggested that the market would bounce around between the 50 and the 200 day EMA Intel making a decision. If that is in fact still valid analysis, then it follows that a break above the 50 day EMA is a good sign. I believe that the market would more than likely continue to see a move higher. In fact, that move would probably be all the way to the $10,000 level above.

That being said, the market is likely to find pullbacks as a potential buying opportunity as the market has done roughly a 50% retrace from the highs recently. The $10,000 level of course is a large, round, psychologically significant figure, so it makes sense that we needed to reach lower levels in order to find longer-term support, in this case the 200 day EMA. The 200 day EMA sits at the $8500 level and it now should in theory serve as a “floor” in the market.

Dips should continue to be looked at as potential buying opportunities, but the question is whether or not we can break above the most recent high. At this point, if the market does manage to do so, then it’s possible that the market goes looking towards the $11,000 level, perhaps even the $12,000 level. The market of course is going to react to risk sentiment, which of course is all over the place right now. I do believe that the Bitcoin market is quite often used as a way to get away from fiat currency. At this point, the market is likely to favor the upside more than anything else as the US dollar is getting hit. The US dollar is getting crushed due to the Federal Reserve cutting interest rates by 50 basis points, being forced into doing the same thing yet again. At this point in time, I believe that we have more upside momentum than down, as the US dollar continues to lose value. The Bitcoin market is priced in the same dollars, so at this point it’s likely that the asset will rise in value when measured against the.