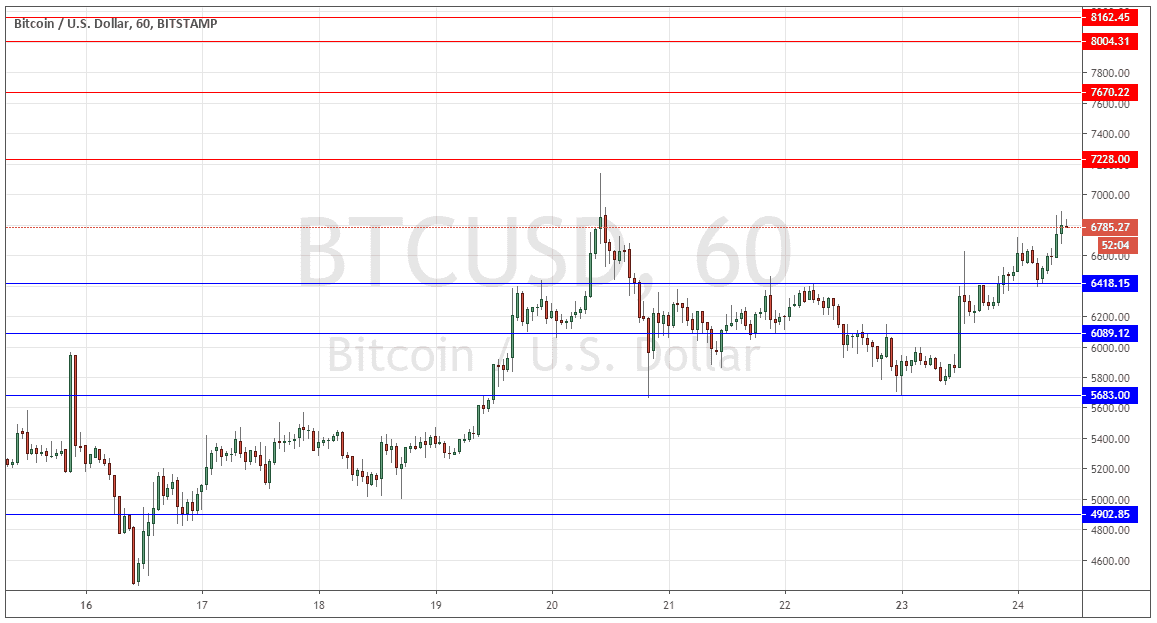

BTC/USD: Pivotal point at $6,418

Yesterday’s signals produced a losing short trade from the bearish reversal at $6,418.

Today’s BTC/USD Signals

Risk 0.50% per trade.

Trades may only be entered before 5pm Tokyo time Wednesday.

Long Trade Ideas

Long entry after a bullish price action reversal on the H1 time frame following the next touch of $6,418, $6,089, or $5,683.

Put the stop loss $50 below the local swing low.

Adjust the stop loss to break even once the trade is $50 in profit by price.

Take off 50% of the position as profit when the trade is $50 in profit by price and leave the remainder of the position to ride.

Short Trade Ideas

Short entry after a bearish price action reversal on the H1 time frame following the next touch of $7,228, $7,670 or $8,004.

Put the stop loss $50 above the local swing high.

Adjust the stop loss to break even once the trade is $50 in profit by price.

Take off 50% of the position as profit when the trade is $50 in profit by price and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

BTC/USD Analysis

I wrote yesterday that I had no faith that a strong bullish movement would happen even if the nearby support held. For this reason, I wanted to avoid trading this pair, or only look for a short trade. This was a wrong call and surprisingly the price has moved up and invalidated resistance.

There is some improving risk sentiment in markets generally as more governments pledge bailouts and financial support, with the U.S. government likely to approve a huge package in excess of $1 trillion soon. This has probably helped the price to recover, and technically it seems that the price has some room to rise.

I will take a weakly bullish bias today if we get a bullish bounce from a pullback to the support level at $6,418. However, I expect the price will fall to new long-term lows over the coming days or weeks. Regarding the USD, there will be a release of Flash Manufacturing PMI data at 1:45pm London time.

Regarding the USD, there will be a release of Flash Manufacturing PMI data at 1:45pm London time.