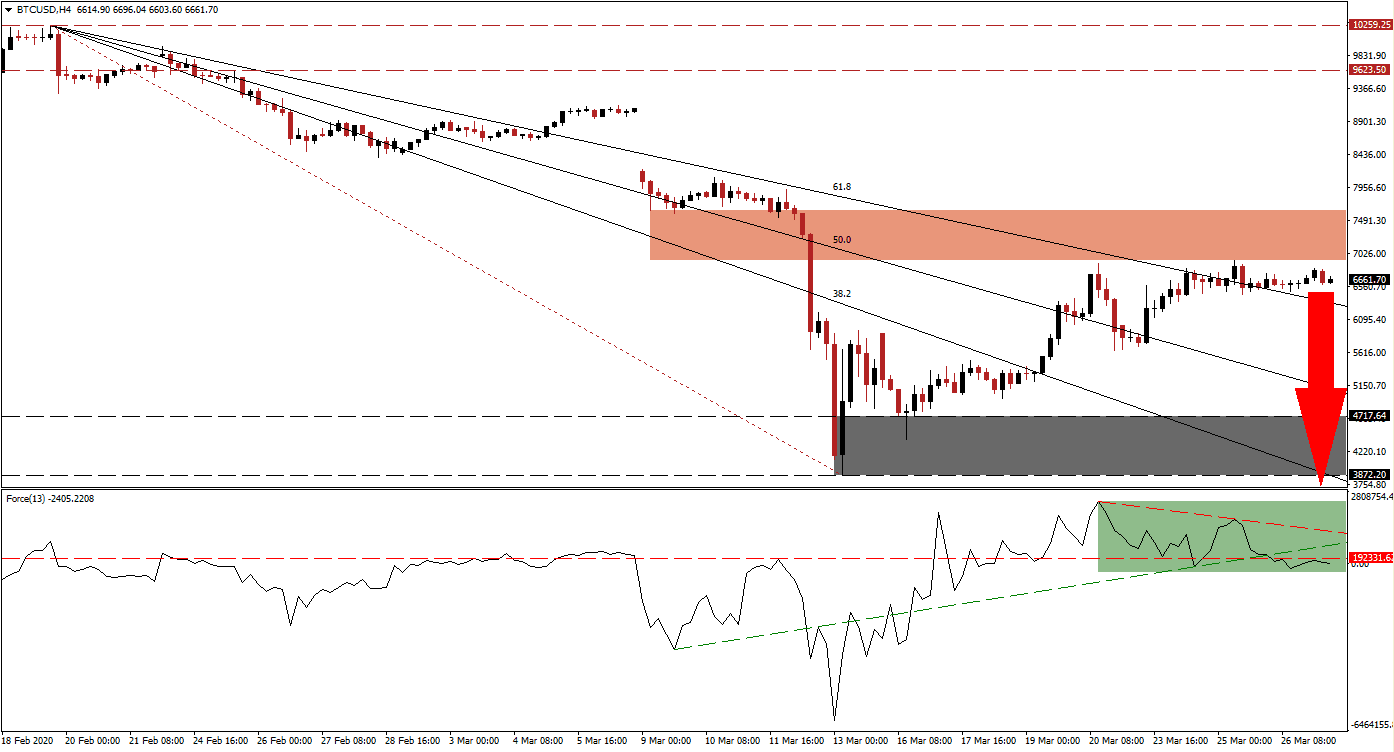

Following the initial meltdown, this cryptocurrency pair was able to recover into the top range of its short-term resistance zone. The advance was fueled by a short-covering rally, and demand from retail traders. Institutional selling pressure collapsed the entire sector, driven by the capital needs of portfolio managers. The sell-off in global equities provided the spark for the massive contraction. Bullish momentum in the BTC/USD is fading, leaving price action vulnerable to a renewed breakdown.

The Force Index, a next-generation technical indicator, points towards the rise in bearish momentum. Two lower highs led to the emergence of a descending resistance level, which resulted in the breakdown of the Force Index below its ascending support level. It additionally converted the horizontal support level into resistance, as marked by the green rectangle. This technical indicator also moved below the 0 center-line, ceding control of the BTC/USD to bears.

Many Bitcoin miners are currently operating at a loss, driving the hashrate down to 75EH/s. It represents a drop of 44% over the past two weeks and the lowest level since September 2019. The Bitcoin difficulty plunged by 16% for its second-largest negative adjustment in history. With the hashrate anticipated to collapse further, the BTC/USD will follow suit. This cryptocurrency stalled after reaching its short-term resistance zone located between 6,926.40 and 7,636.61, as identified by the red rectangle. You can learn more about a resistance zone here.

Given the collapse in the hashrate, more downside pressure is anticipated from the May 2020 halving event, the third in its history, where rewards for miners will decrease to 6.25 from 12.50. The previous two resulted in new all-time highs. The third one is positioned to drive the BTC/USD to the downside, forcing a more massive correction. A breakdown in price action below its descending 50.0 Fibonacci Retracement Fan Support Level will take this cryptocurrency pair into its support zone located between 3,872.20 and 4,717.64, as marked by the grey rectangle. More downside cannot be ruled out.

BTC/USD Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 6,660.00

Take Profit @ 3,870.00

Stop Loss @ 7,350.00

Downside Potential: 279,000 pips

Upside Risk: 69,000 pips

Risk/Reward Ratio: 4.04

In case the Force Index spikes above its descending resistance level, the BTC/USD is expected to attempt a breakout. Due to the dominant bearish fundamental developments, any advance above its short-term resistance zone appears unsustainable. While price action may close a previous price gap to the downside, traders are recommended to use such an event as a selling opportunity. Institutional selling may deliver a second wave of extreme selling pressure. The top of the price gap is located at 9,082.14.

BTC/USD Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 7,950.00

Take Profit @ 9,000.00

Stop Loss @ 7,500.00

Upside Potential: 105,000 pips

Downside Risk: 45,000 pips

Risk/Reward Ratio: 2.33