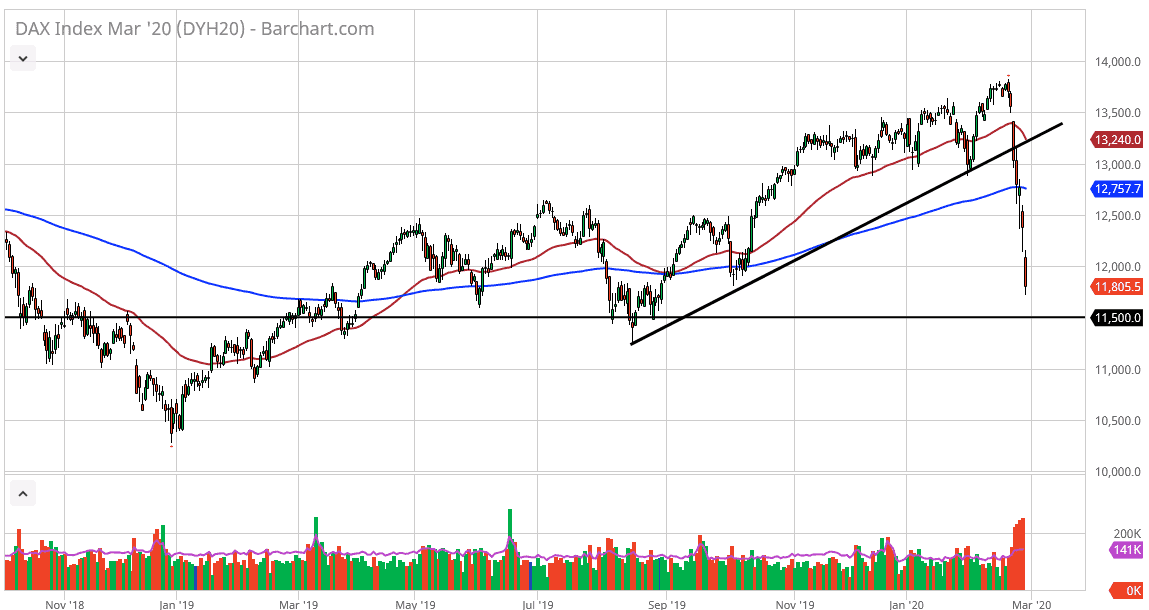

The DAX market gapped lower to kick off the trading session on Friday, reaching down below €12,000 in the futures market. The market continues to be extraordinarily negative, and it seems as if the €11,500 level is next as we had broken below the €12,000 level so significantly. Rallies at this point time should be selling opportunities, because we could try to fill the gap from the open on Friday. Ultimately though, that Should cause quite a bit of resistance. I believe the €12,500 level is very likely to be resistive as well, as it was resistance in the past. Quite frankly, the DAX is going to suffer at the hands of the German recession that seems to be coming, and one should also keep in mind that export markets are going to get crushed.

The German economy is highly sensitive to global exports, as the economy is a major driver of products sent around the world in general. At this point, the market seems as if it is going to freefall right along with the rest of the world, as the coronavirus could very well shut down global supply chains, and that will most certainly influence what happens as far as German exports are going to continue to be hurt by a lack of movement.

At this point, the €11,500 level has been important multiple times, and therefore I would anticipate some type of bounce, or at least slowdown in the selling. Central banks around the world will almost certainly do some type of action and that could have a short-term positive effect on stock markets globally, including the DAX of course. That being said, selling rallies that show signs of exhaustion will be the best way to play this market going forward, and it’s not until we recover the 200 day EMA on a daily close that I would be bullish of this market. When you get massive selloff like this, you almost always get a “dead cat bounce”, so be aware of the fact that it could happen. However, those dead cat bounce is also gets reversed very quickly. Regardless of what happens next, Monday is going to be erratic and dangerous. It is preferable to sit on the sidelines and wait for signs of stability before you start buying. A quick bounce is not what you want to see, you want to see the market build up strength and confidence, not get a simple reactionary bounce.