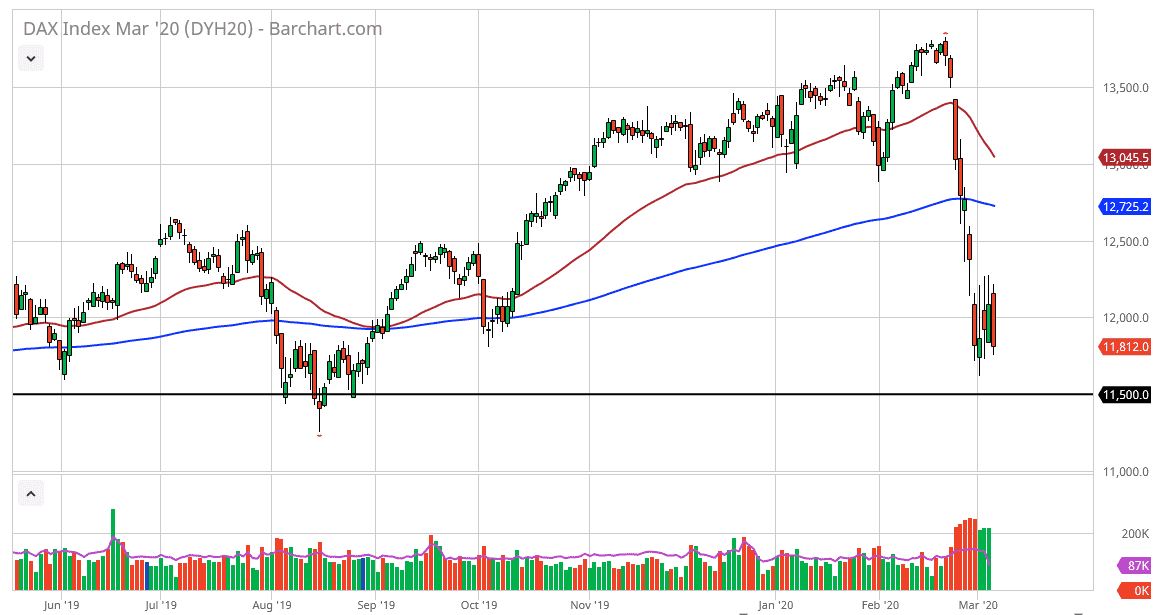

The German index has fallen again during the trading session on Thursday, as the market has been very noisy to say the least. The market seems to be attracted to the €12,000 level, an area that has been important more than once. The gap lower from last week of course signified a lot of softness in this market and I think we continue to see that going forward. It is difficult to imagine a scenario where people want to put on a lot of risk in the German DAX while so much confusion and failure seems to be everywhere.

At this point, it looks as if the €11,500 level should offer plenty of support, but if we were to break down below that level is very likely that the DAX will drop even further. At this point in time, the market is likely to see a lot of erratic and terrified trading, so it’s not until we break above the gap that I think you can put a little bit of faith in this market. Breaking above the €12,500 level would be a strong sign, but right now I think most traders in Germany and Europe in general are waiting to see what the ECB does.

Hourly chart to signify further weakness

The hourly chart has rolled over during the trading session again, and it should be noted that the 50 hour EMA is starting to slope down again. If we can break down below the €11,750 level, it’s likely that the market goes looking towards €11,500 level. If we can break down below there, it’s likely that the market then can continue to the downside. I believe in the short term it’s likely that the €12,000 level probably offers quite a bit of resistance based upon that moving average. This is a market that’s probably best sold on short-term rallies that show signs of exhaustion. Ultimately, this is a market that will offer a lot of volatility, but the Friday session may be quiet until 8:30 AM in New York City, as people will be waiting for the Non-Farm Payroll figures coming out. That will probably throw a lot of volatility around when it comes to the US dollar, and therefore will move markets on the whole. If we start to see the US markets meltdown and the Euro rally as people run away from the dollar, that will probably send the DAX to the downside.