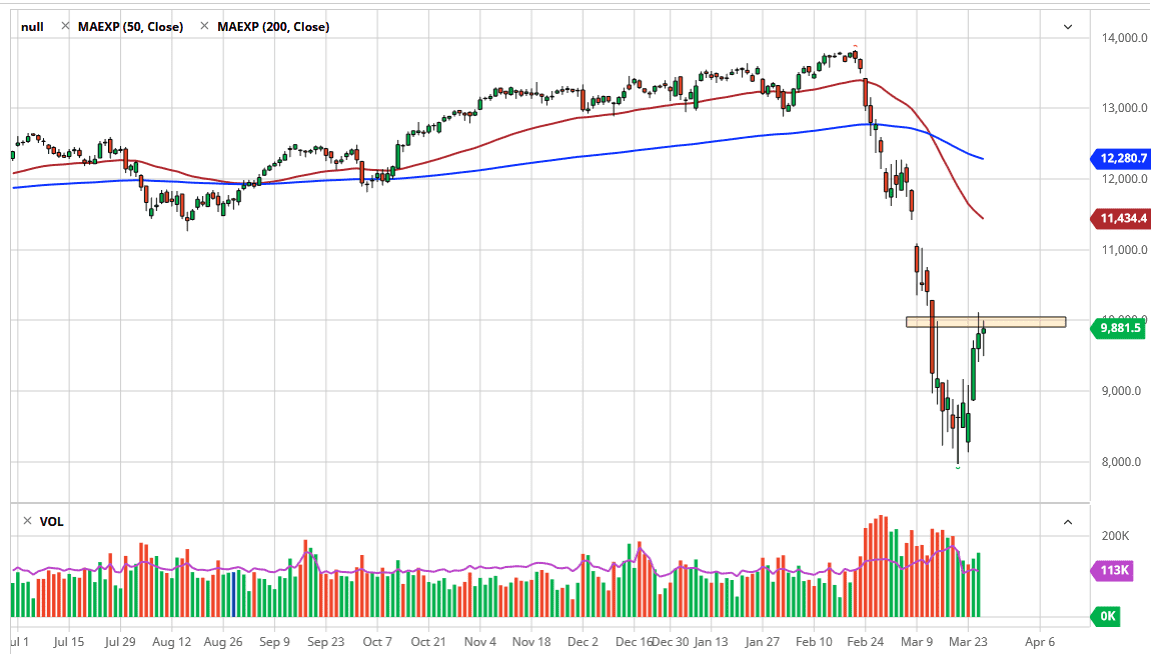

The German index initially fell during the trading session on Thursday, reaching down towards the bottom of the candlestick from the Wednesday session. This initially looked as if the market was going to rollover from this significant bounce, but later in the day we had seen the buyers jump in and push towards the 10,000 level. This area is obviously a large, round, psychologically significant figure and of course it will attract a lot of attention. The market also has struggled with this level during the trading session on Wednesday, so now the question is whether or not it can hold?

Looking at the candlestick, it does look like it’s very bullish, so if we can break above the top of the candlestick from the Wednesday session, it would be a break of significant resistance. There is a tiny gap just above, but I don’t think the markets going to pay too much attention to that. The next major barrier is going to be the 11,000 level above, which is the bottom of the massive gap on the chart. At this point, the market would probably be running into the 50 day EMA which is painted red on the chart.

The alternate scenario of course is that the market rolls over and falls from here. If we were to break down below the candlestick during the trading session on Thursday, it would then turn that candlestick into a “hanging man”, which is a very negative sign. At that point, it’s likely that the market goes looking towards the 9000 level underneath. Furthermore, we could even retest the bottom again, which is typical after some type of major meltdown like we have just had. After all, markets like to be reassured that the bottom is actually in. This is quite often done by retesting the bottom but making a “higher low”, which is exactly what the DAX needs to see at this point. The European Central Bank is going to liquefy the markets however they can, just as other central banks are. That should help stock markets over the longer term with plenty of that cheap money that traders like so much. The 8000 level underneath will be crucial in determining whether or not the market can hold its own and continue to go much higher. The gap above the measures to the 11,500 level, which would be the target longer-term.