The Euro has shot higher during the trading session on Friday, but then broke down a bit only to turn around and rally again. The Euro is all over the place and it will be interesting to see how this plays out on Monday, as Jerome Powell suggested that the Federal Reserve was willing to take “adequate measures” in order to protect the economy. A lot of traders out there are reading into that statement that the Federal Reserve is getting ready to cut rates, so that has worked against the value of the US dollar late in the day. Having said that, the European Central Bank has shown a proclivity to loosen monetary policy even further, and at this point the European Union is almost certainly going to head into recession.

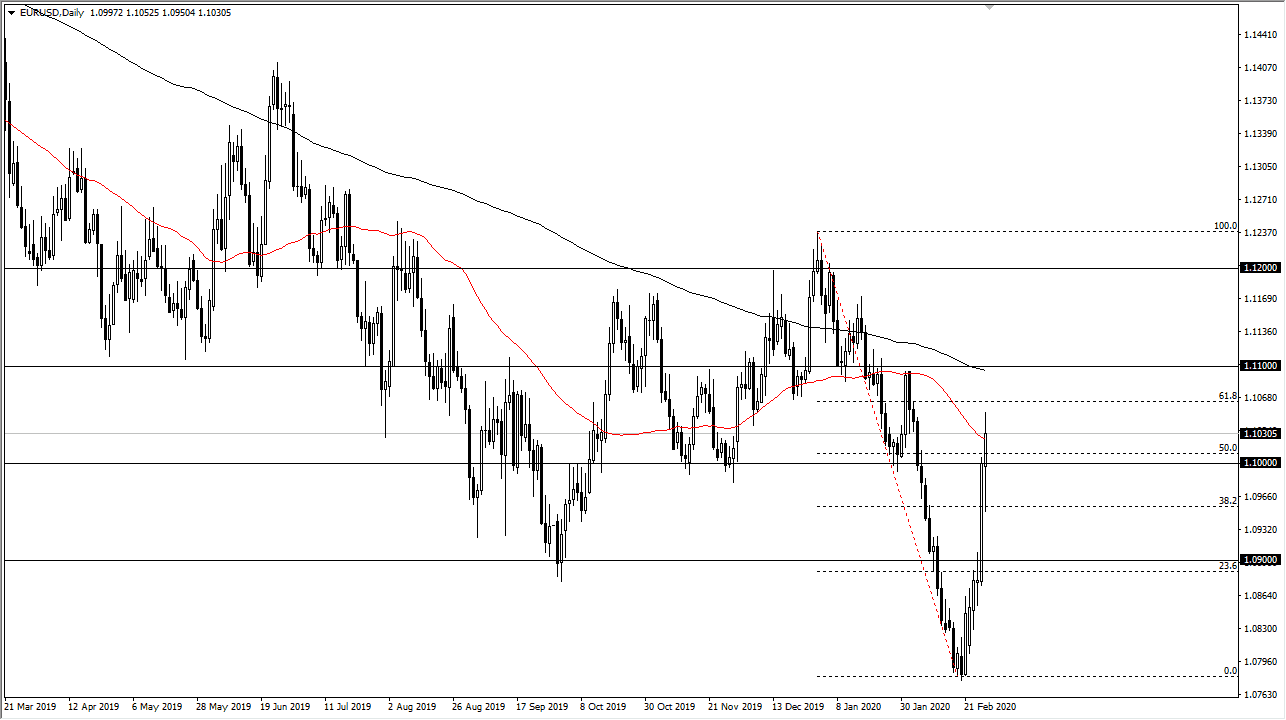

That being said, the market is likely to run into a certain amount of resistance given enough time, and I do think that there is a lot of noise between the 1.10 level and the 1.11 level in this market, and I do think that we turn around eventually unless of course the Federal Reserve takes some type of unilateral action over the weekend. We are still very much in a downtrend, and even with this massive bounce higher, that has not changed.

At this point, I’m looking for some type of exhaustion that I can take advantage of. If the market rolls over and breaks back below the 1.10 level, I will be a seller as we should continue to reach down towards the 1.09 level, and then eventually the 1.08 level. A breakdown below that level should then open up the door down to much lower levels, perhaps even as low as the 1.06 level. After all, the United States economy is outperforming the European economy, and therefore once things calm down, we should continue to see the US dollar strengthen quite a bit of, as it had previously. This has been a nice bounce, but I think overall it’s just simply going to be looked at as a pullback over the longer term. If the market does break above the 1.12 level, then I would consider buying for a longer-term move but right now I don’t see that happening. One thing is for certain, the Monday open should be rather interesting, so therefore keep your position size rather small regardless of what to do.