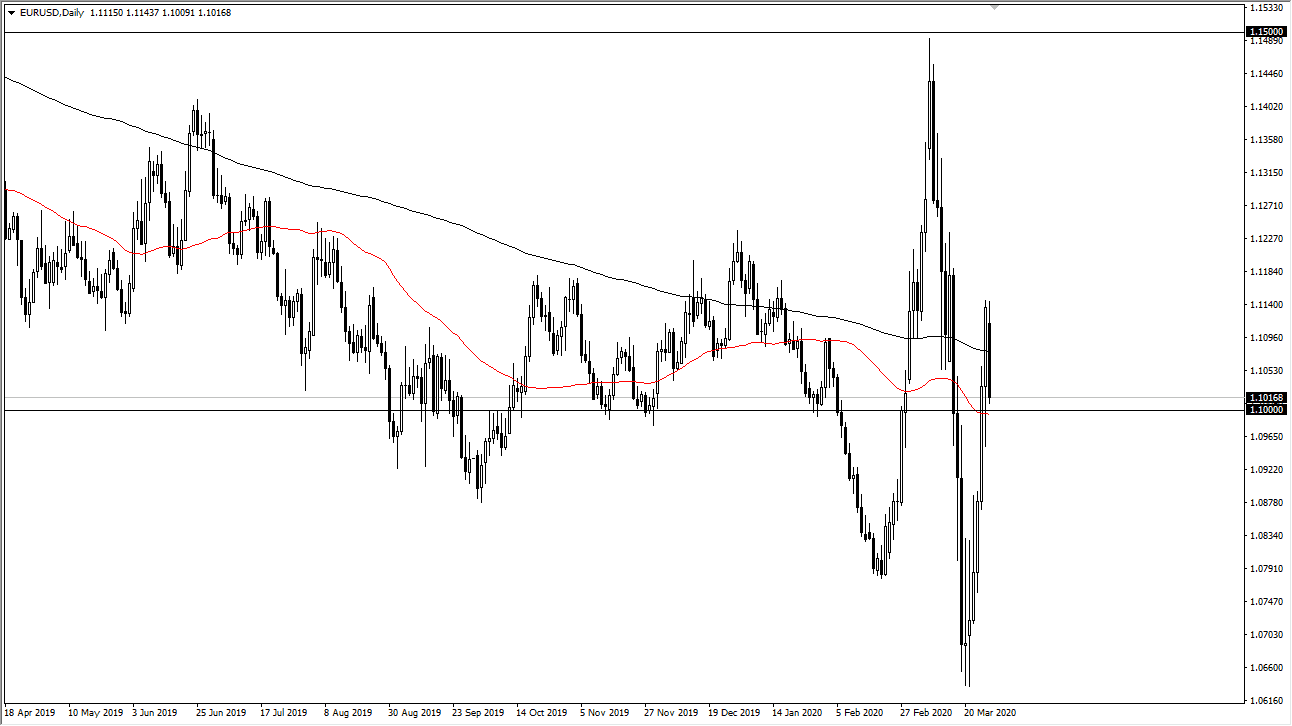

The Euro initially tried to rally during the trading session on Monday but has seen a lot of resistance at the 1.1150 level. At this point, the market then rolled over significantly to go looking towards 1.10 level underneath. Ultimately, this is a market that is going to continue to jump back and forth because both central banks are going to liquefy the markets and loosen monetary policy. At this point, the market is very likely to continue to punish both currencies in general, so this is essentially a fight between a couple of lightweights. Keep in mind that both of these central banks are doing what they can to devalue currency.

At this point in time, it’s obvious that the US dollar is leading the way, considering that the Federal Reserve is throwing dollars out in the marketplace rapidly. That of course puts a little bit of bearishness on the US dollar in you can see that we rallied significantly in this pair after that happen. Having said that, the market is now starting to focus on the European Union and its poor economic output. At this point, the market continues to be very noisy, and I think that it will continue to have erratic behavior. If we get a daily close below the Friday low, then the market goes down to the 1.07 level. Alternately, if we were to break above the highs of both Friday and Monday, then the market more than likely would go looking towards the 1.12 handle, and then eventually the 1.14 handle after that. At this point, the market continues to see a lot of volatility so keep your position size relatively small. If we were to break down from here, then I think the market would get somewhat aggressive to the downside, while I think a rise in the Euro might be a little less aggressive in its movement. For what it’s worth, the 200 day EMA is currently slicing through the middle of the candle and that of course is going to be something that people pay attention to in general. Having said that, the market continues to be very noisy so therefore you should probably keep your position size down in order to protect your account in this dramatic time. This is much more like 2008, when the next headline would throw the markets into absolute disarray.