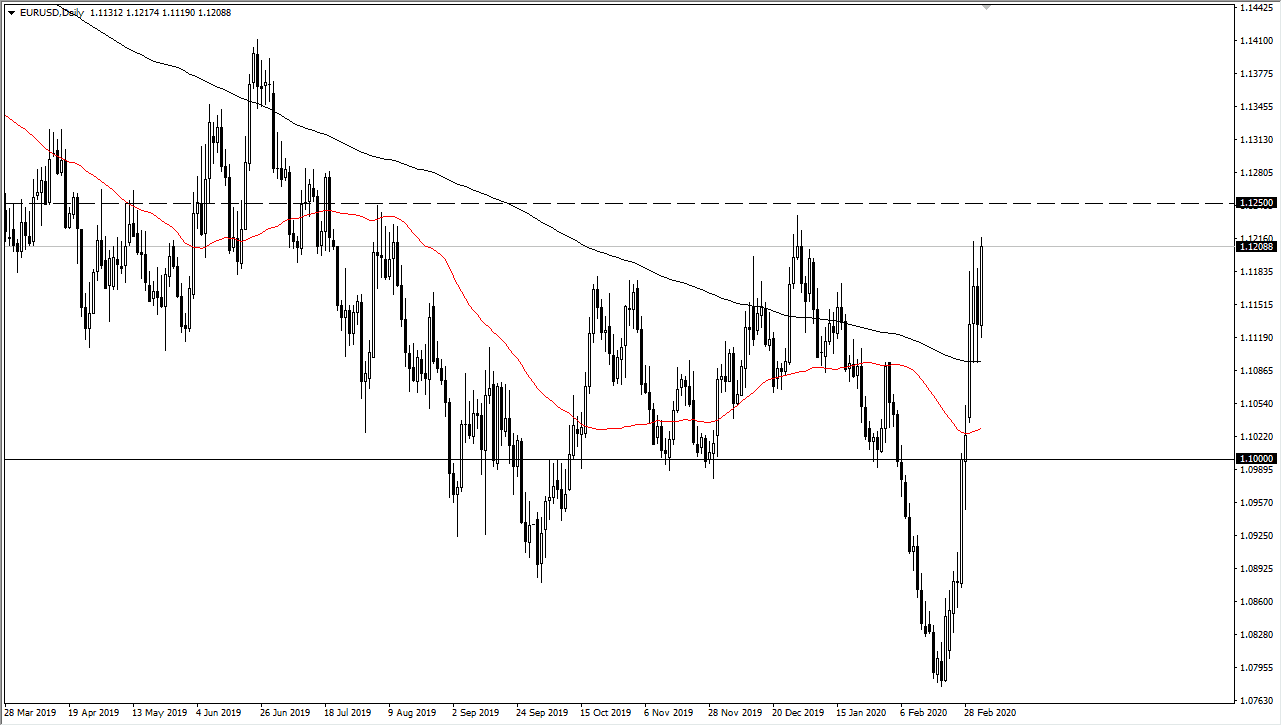

The Euro has rallied significantly during the trading session on Thursday, showing signs of even more strength as the market is likely to go looking towards 1.1250 level based upon the fact that the Federal Reserve is likely to continue cutting interest rates going forward. The Fed Funds Rate Futures market is pricing in another 50 basis points as far as a cut is concerned, so market participants are in fact going to push the Federal Reserve into cutting rates again. After all, the Federal Reserve has proven itself to be a slave to Wall Street, and as a result it’s likely that the Federal Reserve will in fact do the cutting that everybody is anticipating.

The candlestick of course is a very bullish looking candlestick and as we are closing towards the top of the range it suggests a bit of follow-through. With the jobs number come out on Friday, we will more than likely see a lot of choppiness. At this point though, I anticipate that any pullback in this pair will probably be an opportunity to pick up a bit of value in the Euro. In fact, it’s not until we break down below the 200 EMA that I would be negative.

Hourly chart shows continued uptrend

The hourly chart has shown signs of strength yet again, as we continue to grind on short-term pullbacks. Ultimately, I do think that this market is probably going to go looking towards that previously mentioned 1.1250 level, but I look at a couple of levels underneath as potential value areas. I believe that the 1.1130 level is an area that buyers will probably be interested in, and most certainly the 1.11 level will be. I don’t know whether or not we will go that deep, but unless there is some type of major shift in risk sentiment or perhaps the employment situation, it’s very likely that the market will continue to be the exact same way it has been previously. That being said, if the market does break above the 1.1250 level on a daily close, that will more than likely kick off a longer-term trend change. If we were to break down below the 1.10 level, that could throw a lot of havoc into this market. Ultimately though, I do like the idea of picking up bits and pieces of value when it comes to the Euro in general.