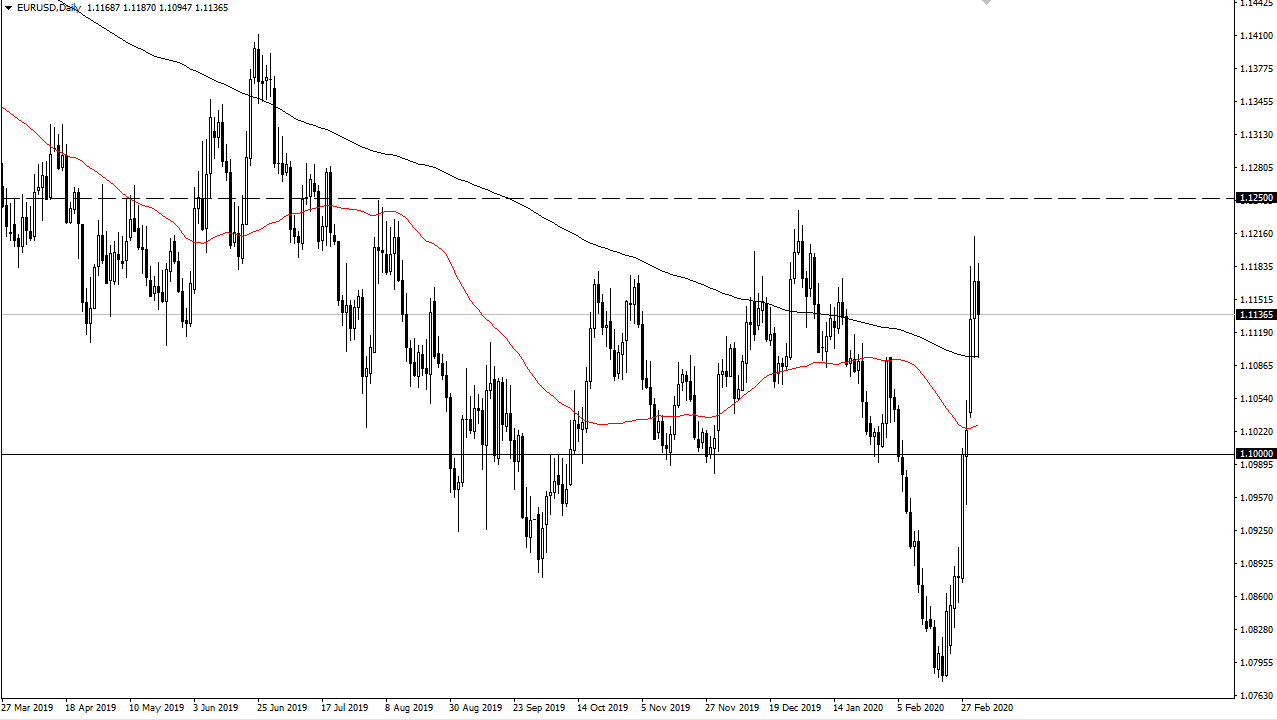

The Euro initially tried to rally during the trading session on Wednesday but found support at the 200 day EMA just as it did during the previous session. Ultimately, this shows that there is a lot of interest in this area, so therefore I think we probably will continue to see a lot of noise. The 200 day EMA should continue to be thought of as a support level, so if we do drift down towards that area, I anticipate the buyers will probably return. That being said, one of the biggest drivers of this market is that the Federal Reserve is being pushed into doing another 50 bps of rate cuts. At this point, the market is likely to continue to look at the 1.1250 level above as a major resistance barrier. If we can get above there, then the longer-term trend for the Euro has just changed.

That being said, it is difficult to get overly excited about the Euro, but this is purely about the Federal Reserve more than anything else. Alternately, if we break down below the 200 day EMA then it opens up a move to fill the slight gap that started the week off, which also has the 50 day EMA sitting there.

Hourly chart looks sideways

The Hourly chart has gone back and forth over the last couple of days, as we continue to try to discern where we are going next. I believe that the 1.11 level is important from a short-term standpoint, as it has offered a bit of buying opportunities. If the market were to break down below the 1.11 level, then I think it lines up quite nicely to go down to the 1.10 level underneath, where the 200 hour EMA is starting to reach towards. A breakdown below that level would show a significant weakness. However, I think that traders are paying less attention to Your right now and more attention to the Federal Reserve. The Fed Funds Rate futures are being pushed towards rate cuts, in the Federal Reserve has already shown that it will in fact do whatever the traders tell it to. With that, one would have to assume that the US dollar will continue to get a bit hit, especially if the US can continue to throw cheap money into the marketplace, something that central banks around the world are screaming for.