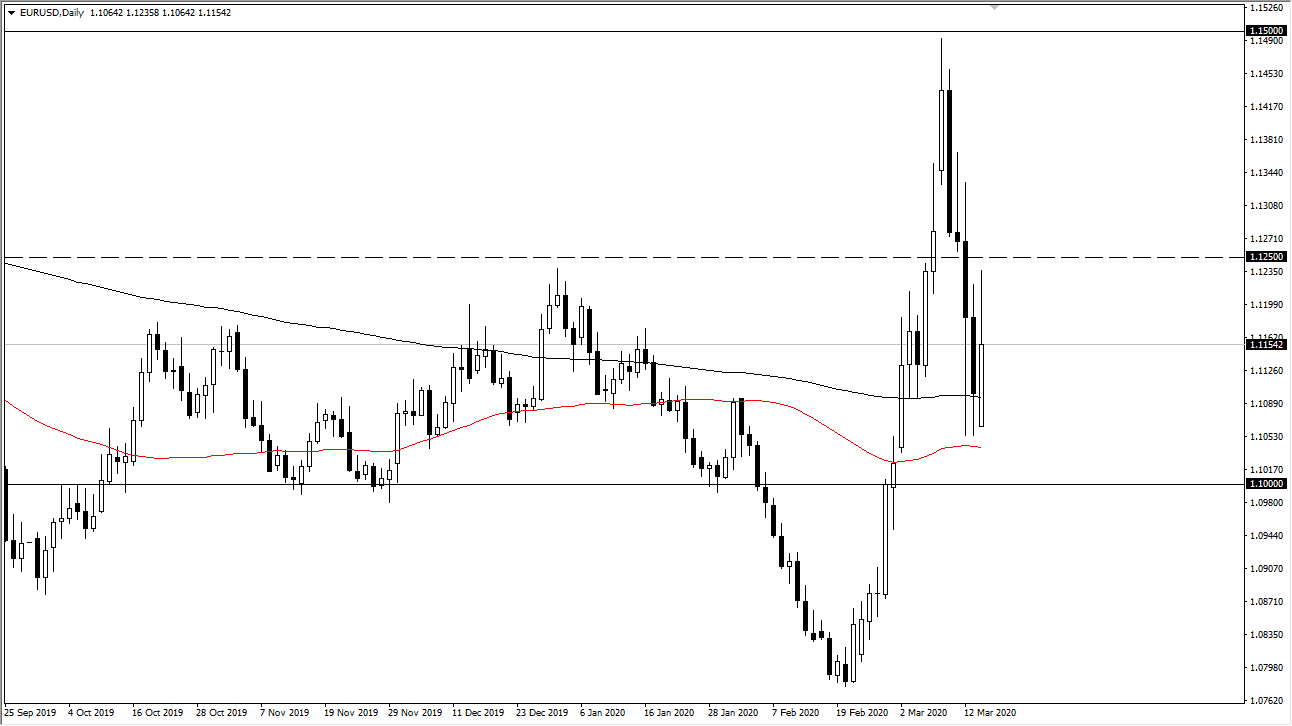

The Euro has rallied significantly during the day on Monday, reaching towards 1.1250 level before pulling back a bit. The 50 day EMA sits just below the bottom of the day and is also the same place that we had seen bounces over the previous two sessions. Overall, this is a market that tends to be very choppy anyway, so it should not be a surprise that we would be forming a new range. This is one of the worst Forex pairs to trade under normal circumstances, simply because it doesn’t move much. That has obviously changed over the last couple of weeks though with the coronavirus breaking out everywhere.

Looking at the chart, the 1.1250 level is likely to offer resistance going forward, and as long as we stay underneath that level, I think we are going to be trading between 1.10 the bottom and 1.1250 on the top. That’s a 250 PIP range, which for this pair is very large. That being said though, if we can break above the 1.1250 level, then it’s likely that we go looking towards the 1.14 handle, possibly even the 1.15 level. In general, you need to be looking at the possibility of a range bound market considering that we have slammed it back and forth with ferocity, and therefore one would have to think that eventually the market will continue to play ping-pong in a smaller range.

Looking at the candlestick for the trading session on Monday, it did show quite a bit of bullish pressure, but it also gave back quite a bit of that same pressure. This tells me that the 1.1250 level is still being respected as resistance, so I’m looking at the possibility of shorting on rallies towards that area. Furthermore, the 50 day EMA is just above the 1.10 level, which is massive support. With that being the case it’s likely that the market finds these two areas crucial enough to go back and forth from. If you have a range bound trading system, this might be the time to employ those type of set ups, but keep in mind that we are still moving on the latest headline, so you need to be very cautious about getting far too over levered on any position that you have. In fact, that’s probably sage advice for just about any currency pair right now, trading about half of your normal size.