The Euro has rallied yet again during the trading session on Monday, reaching towards the 1.1175 level, as there are more bets that the Federal Reserve is going to continue cutting rates, perhaps even as much as seven bps between now and the end of March. That being said, the US dollar has sold off against many other currencies but I think it’s somewhat overdone.

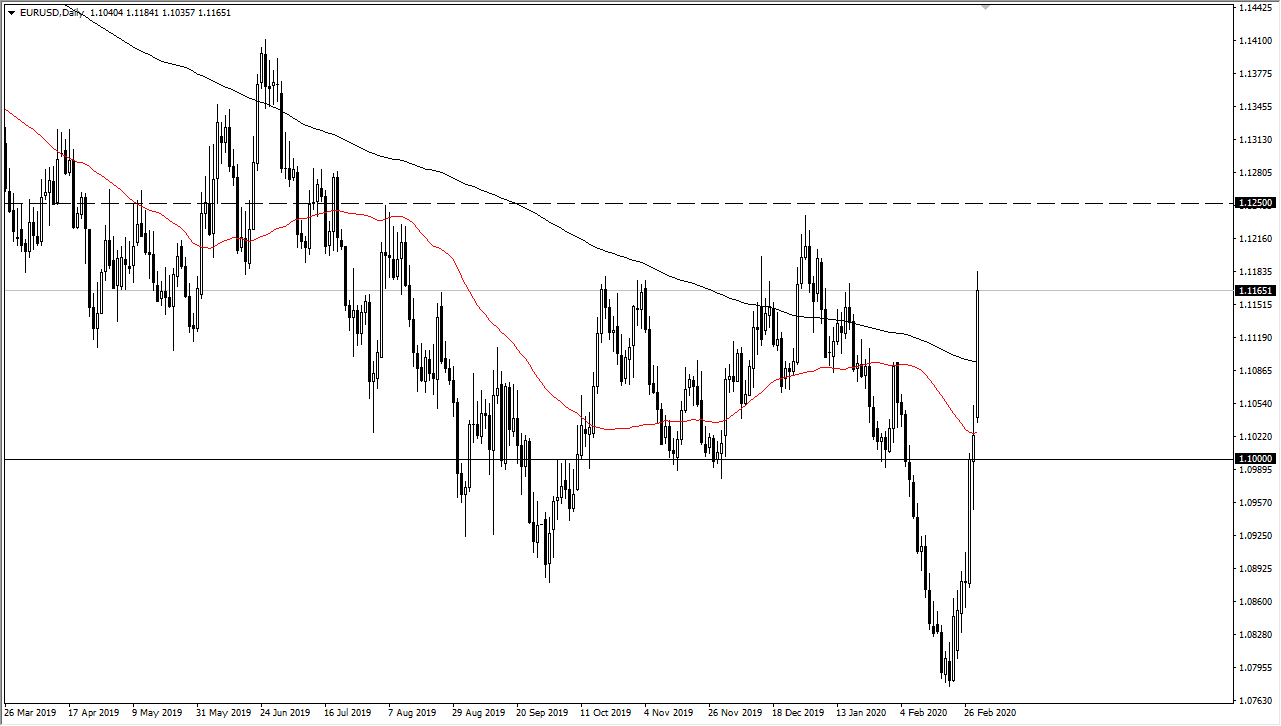

The basic premise it is this: if the Federal Reserve can cut 75 basis points, and the European Central Bank is out of normal rate cutting possibilities, then there is a certain amount of adjustment that needs to be made to the currency pair. That being said though, it’s a bit overdone. At this point, a bit of a correction is probably necessary, and you should be aware the fact that the 1.1250 level is an area that has been significant resistance in the past. We are getting relatively close to that level, so it’s likely that we rollover again on signs of exhaustion.

That being said, if the market does rollover, it’s likely that we could fall rather significantly in order to get back to a reasonable value, and even though we gapped higher during the session, it would not be overly surprising to see this market pull back to try to fill that gap which is sitting at the 50 day EMA. That being said, the market was to break above the 1.1250 level, then it’s likely to continue going much higher, perhaps as high as the 1.15 handle. I think this nasty volatility is something that we should get used to, because the coronavirus is going to be around for a while, and there is very little that central banks will be able to do in order to stem the damage. So, having said that it’s going to come down to markets trying to find the best way to absorb liquidity. Currently, it looks as if the market will remain very dangerous so keep your position size much smaller than usual, because quite frankly your losses could get out of hand rather quickly. That being said, we will eventually get a bit more clarity but in the meantime it’s so difficult to trade this market that you should not get overly convicted in one direction or the other. I do believe that the 1.1250 level will be a bit overdone if we get there quickly, and I would anticipate that the selloff or even a correction if you want to call it that, could be rather drastic.