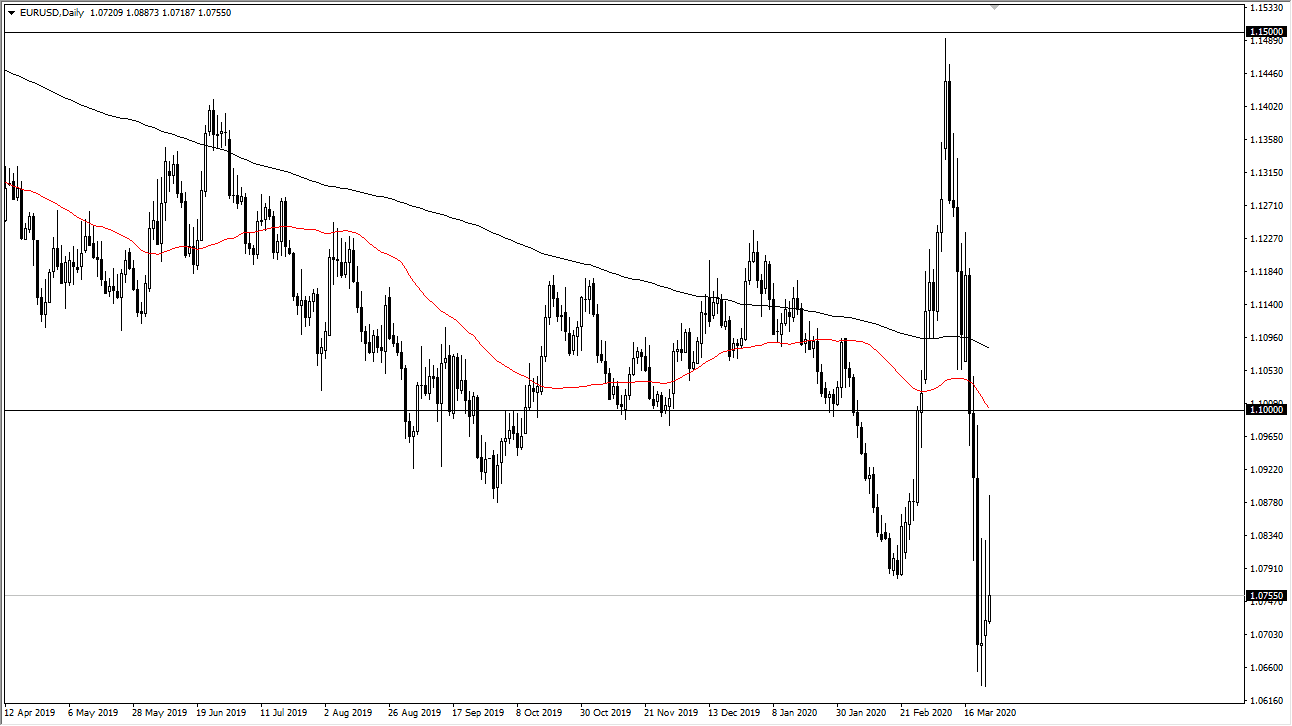

The Euro rallied a bit during the trading session on Tuesday but gave back a significant amount of the gains in order to form a bit of an inverted hammer. This will be the third one in a row that has formed, as it’s obvious that the Euro is not a currency that people wish to hold. It ended up giving back a complete handle from the highs, showing just how weak the currency pair is. Depending on what time a day you are trading, you may have missed the opportunity to trade this altogether. Ultimately, I do like fading rallies as it continues to work but we have broken through the top of a couple of inverted hammer’s during the session, which does show that at least there is a certain amount of resiliency to the buying.

Looking at this chart, I do believe that we will test the lows again based upon the fact that we simply cannot hang on to the gains. Even if we do break out to the upside, I believe that the 1.10 level will also be resistive, so any upward momentum is probably somewhat limited, and therefore I will be looking for daily candlesticks that tell me it’s time to start selling again.

The Federal Reserve has thrown a ton of liquidity into the marketplace and is likely to bail out just about anybody they can. Furthermore, the US Congress is looking very likely to throw a ton of money at the economy as well, so one would have to think that the US dollar may lose a little bit of its luster. In fact, one would think that the Euro would be able to capitalize upon it. However, it has not and that tells you just how weak the Euro is in general. Because of this, I am still looking to fade rallies, at least until we get a daily close above the 1.10 level which could change my attitude a little bit. To the downside, if we break down below the lows, then we will try to take out 1.05 and then move on down to the parity level. All economies around the world are grinding to a halt but the European Union was a special kind of basket case to begin with, so this can only be exacerbated at this point in time. Adding more to the lack of confidence is the fact that short selling has been banned in several large European stock markets now.