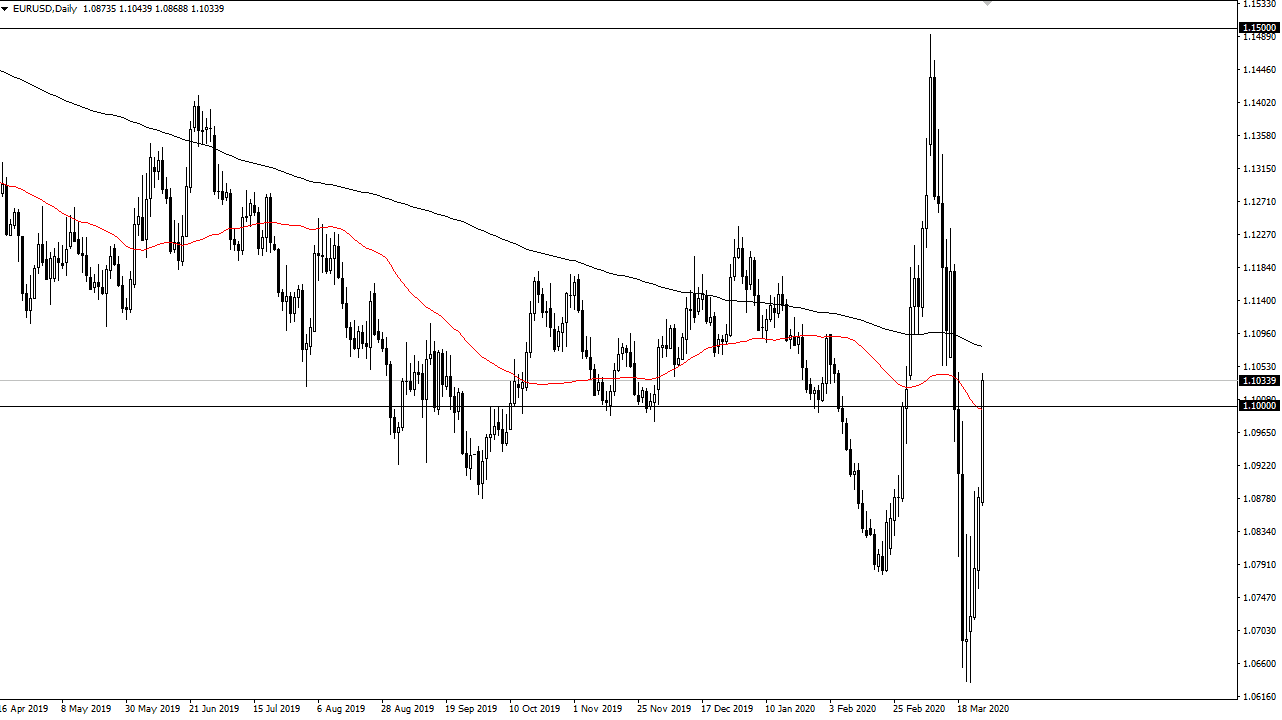

The Euro has rallied a bit during the trading session on Thursday, breaking above the 1.10 level. That being said, there is a significant amount of noise between there and the 1.11 handle, so I think it’s only a matter of time before we have to make a decision as to whether or not we can break out to the upside. I would draw your attention to the recent attempt to break above the 1.10 level and the pullback. At this point it looks like we are trying to break through there, but beyond that the 200 day EMA above will more than likely offer resistance near the 1.11 handle.

That being said, the Euro really doesn’t know what to do with itself right now because we have seen so much in the way of both bullish and bearish pressure as of late, and I think that we are simply batting back and forth in order to try to find some type of longer-term direction. One thing is for sure though, you could make an argument for the volatility being the bottoming process after a very long term downtrend. In the short term though, I think it is probably asking a bit much for the trend to turn around, as the European Union has so much in the way of negativity surrounding it.

The Federal Reserve is going to jump in and do quantitative easing yet again, and that will work against the value of the US dollar in general. At this point, I think it’s very likely that the end of the week should tell us where this market is going to go for a bigger move. In fact, I’m staying out of the Euro during the trading session on Friday and simply letting the market make up its own mind. With that in mind, I believe that we could see a lot of choppiness during the trading session but the weekly close is going to be crucial as it could give longer-term credence to either a breakout to the upside, or the overall negativity. I will update this in 24 hours, because the weekly candlestick will give us much more clarity than the next 50 pips well. That being said, I still am relatively negative on the European Union in general. At this point, the ECB is in quantitative easing, and so is the Federal Reserve. In other words, it’s very likely that the market is going to continue to be very noisy because of this.