US President Trump has provided some support to the collapsed US dollar by announcing plans for his government to mitigate some of the Corona pandemic effects in his country. Therefore, the EUR/USD price moved down to 1.1275 before settling again around 1.1345 at the time of writing. The Pair’s gains in the beginning of this week’s transactions hit 1.1496 resistance, the highest level pair since January 2019, in light of the USD and the US stock markets collapse, with increasing fears that the US economy will be harmed by the start of the Corona’s epidemic in the country. What added to these fears was the sudden decision of the Federal Reserve to cut American interest rates by half a point.

The decline in the Euro came at a time when the Italians spent their first day in the general "closure" nationwide as travel was severely restricted to prevent the spread of the Corona virus, the Italian government's decision likely to cause a severe blow to the economy in the first and second quarters. Investors will now have to face the possibility of implementing such measures in other major economies as well, most likely in the United States, as although calm has returned to financial markets, and the Euro was dropping before President Donald Trump's announcement. It is expected that these decisions will result in a "significant relief" for companies and families as it prepares for a possible increase in cases of infection with the Corona virus after handing four million test groups to the states on Monday. Therefore, the increase in cases may be announced in a short time, which will be negative for the US dollar.

In this regard, US President Donald Trump said he wants to make sure that Americans “will not miss any salary” as a result of the virus that disrupts business and can force many to self-isolation, with a number of industries stopping and which will need immediate assistance. Despite that optimism, National Economic Council director Larry Kudlow told CNBC on Tuesday that any decisions on "spending or taxes" would require approval by Congress and would take some time.

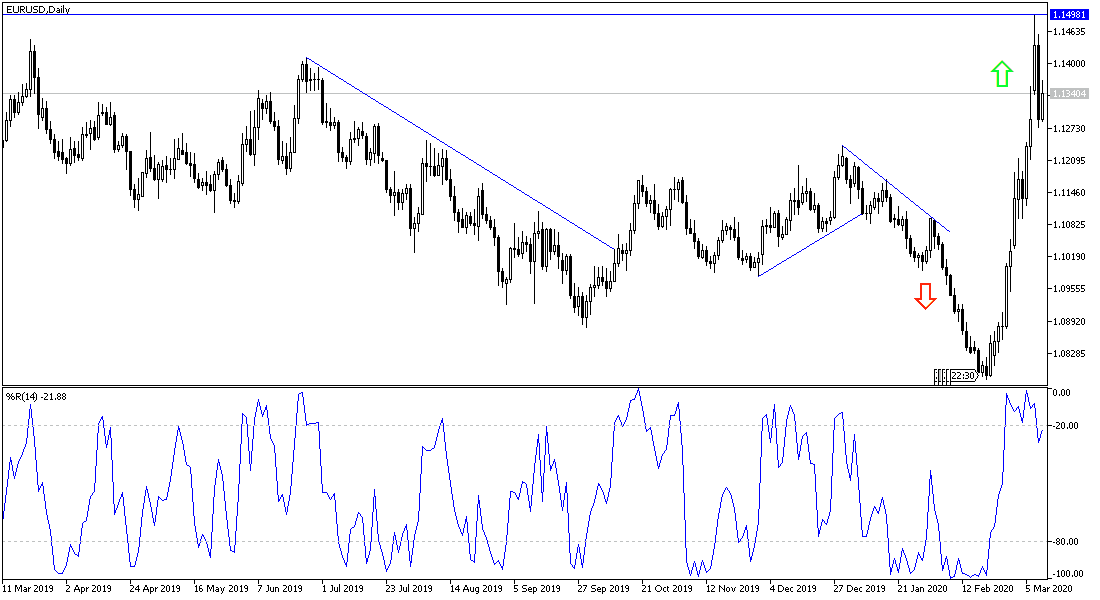

According to the technical analysis of the pair: Despite the recent rebound in the EUR/USD pair, it remains in an upward channel range as long as it sticks to the performance above the 1.1000 psychological resistance - current psychological support - and the resistance levels of 1.1390, 1.1452 and 1.1600 will remain legitimate targets for the bulls taking into consideration that the decisions of the European Central Bank tomorrow may reduce the chances of the Euro achieving stronger gains. On the downside, any move below the 1.1000 level will break the current channel, and the actual reversal will start if it moves more towards support at 1.0920.

As for the economic calendar data today: The focus will be on the announcement of the US economic data; the consumer price index and statements by the US Treasury Secretary that may affect the pair.