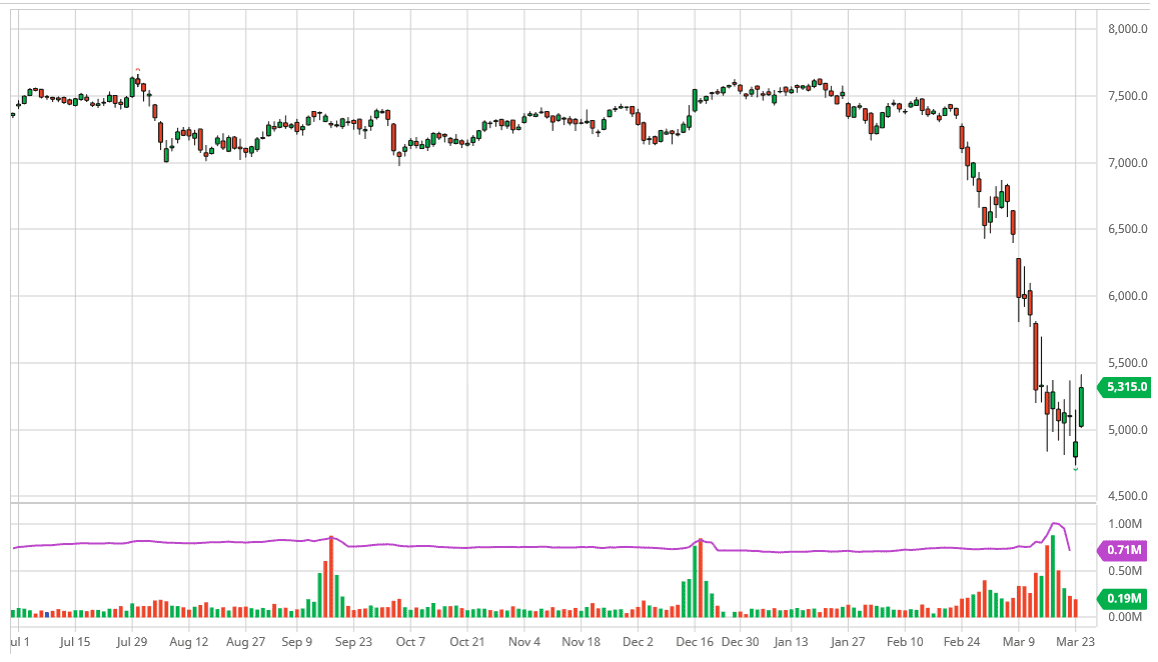

The FTSE 100 gapped higher to show extreme signs of strength, as the market jumped above the 5000 level in the futures contract. At this point, the market then shot straight up in the air to reach towards 5400. There is a significant amount of resistance in that general vicinity, and therefore the fact that the market could not break through there immediately should not be a huge surprise. Furthermore, I believe that the 5500 level should offer even more resistance. This is a large, round, psychologically significant figure and an area where we had formed an inverted hammer at previously.

Beyond that, there are a lot of concerns in Great Britain about the fact that the UK economy is going to be shut down extensively for the next several weeks. This of course will have a great influence on the profitability of UK companies, but in the same breath you can also say that the worst case scenario has already been realized. In this scenario, I think that the market probably goes back and forth in order to form some type of base, and somewhere near the 5000 level makes just as much sense as anywhere else because of the psychology involved in that region.

On a daily close above the 5500 level, at that point I think the market will go looking towards the 6000 level next. It won’t necessarily be the easiest move, but it should be noted that in a bear market you get the occasional monstrous relief rally. That could be what the FTSE 100 is setting up for, so be advised that the 5500 level is most certainly the gateway going forward. Alternately, if the market was to break down below the inverted hammer from the previous session on Monday, that would be an extraordinarily negative sign. At that point, 4500 would certainly be the initial target. Nonetheless, I think that would take some type of shock that goes beyond what the market has already struggled with.

What is most impressive about this market right now is the fact that after the announcement of the three which shut down of the UK, it didn’t melt down. That shows you that perhaps bad news is starting to be taken for granted, and it is in these times where turnarounds can happen. Because of this, I am more optimistic than previous, but I still think we have more of a process to go through the and some type of sharp turn around.