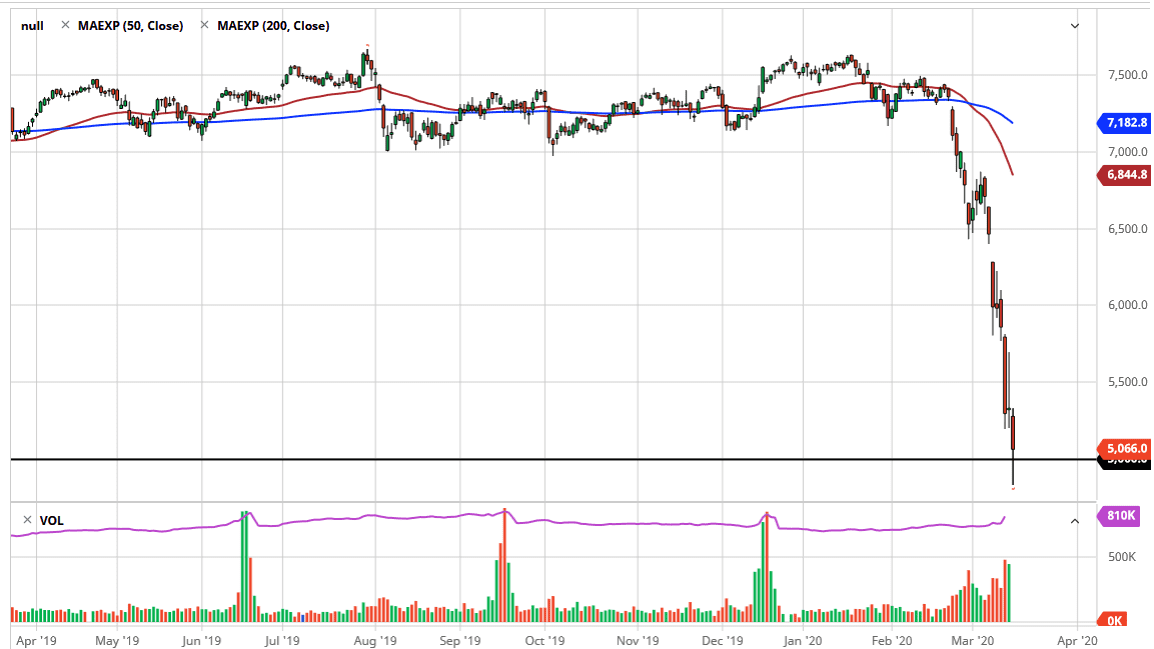

The FTSE 100 broke down rather significantly during the trading session on Monday to open up the week, as one would expect. After all, there is nothing but fear in the marketplace right now as the coronavirus continue to shut down the global growth and economy. With that, the FTSE 100 isn’t going to act any better than anywhere else, and there are concerns about the outbreak in the United Kingdom anyway. At this point, the 5000 level is being targeted, and quite frankly it’s an area where you would expect a lot of interest.

Markets have been oversold for some time, and it’s only getting worse. I think at this point we are likely to see a lot of back and forth, but I would anticipate that we could get a little bit of a bounce in this area. This is the thought that a lot of my contemporaries, simply because the market definitely need some type of relief rally. If the market takes out the top of the money candlestick, then it’s very likely to go looking towards the 5500 level, and then the 6000 level. Don’t get me wrong, I don’t necessarily think that we are going to take off to the upside for a bigger move in the short term, but clearly some type of bounce makes sense.

Not only that bounce makes sense, but also selling closer to the 6000 level makes sense as well. Selling signs of exhaustion should continue to be the best way approaching this market, but there is also the alternative scenario where we simply break down below the lows of the trading session on Monday. If we do break down below there, then the market is very likely to go looking towards the 4500 level, possibly even 4000. At this point, I believe the only thing that you can probably count on is going to be a significant amount of volatility, as stock markets continue to get hammered on the latest headlines. Eventually though, longer-term big-money players start to come in and pick up stocks “on the cheap”, in the beginning of what would be stabilizing of markets around the world. There does seem to be a bit of a “rolling bear market” in the sense that what happens in London will probably be greatly influenced by what happens in New York and Tokyo. If they can get some type of rally going over there, that may help it happen here.