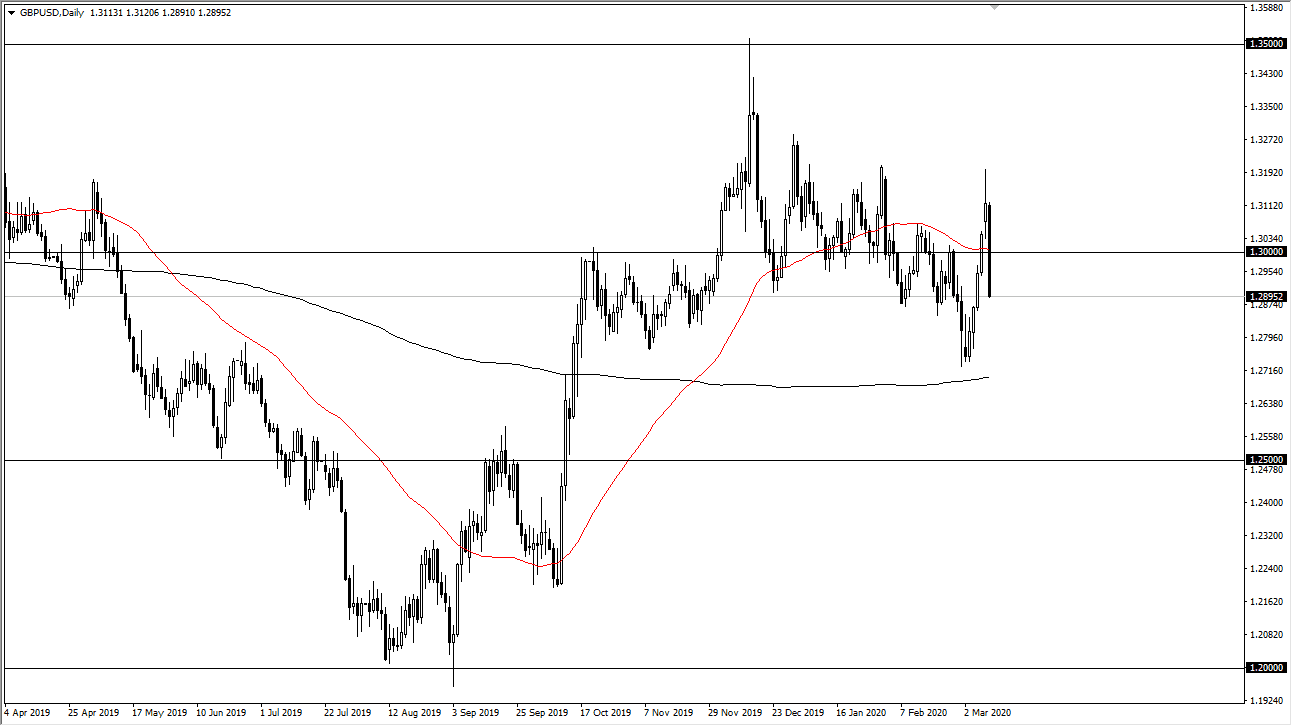

The British pound has broken down during trading on Tuesday, as the US dollar got a bit of a boost after being oversold against Sterling. At this point, the market has sliced back through the 1.30 level and is currently threatening the 1.29 area. That is an area that has been supportive in the past, and a breakdown below that level should send this market towards the 200 EMA. The 1.27 level is an area that attracts a lot of attention not only due to the fact that it was the scene of a recent bounce, but it is also the scene of the 200 day EMA.

If we were to break down below that level, then it’s very likely that the British pound reaches towards the 1.25 handle. At that point, I would expect big figure traders to come in and try to support Sterling, but I would not expect a major turnaround without some type of headline.

The alternate scenario of course is that the British pound recaptures the 1.30 level, which would be a bullish turn of events and could send this market back towards the 1.32 level. It will be difficult to gauge where we go next, mainly because this is going to hang on the reaction of the market to whatever fiscal stimulus package that the US government comes up with. Because of this, we have to watch the couple of levels before putting money to work, but it’s obvious that the candlestick for the trading session is very negative.

One thing I think you can count on is a lot of volatility because of the risk appetite of traders around the world. At this point in time, the market looks very likely to see a lot of noise and a lot of nervous trading. Without a doubt, and not only in this market, the best advice that I have heard is to keep your position size small while trying to figure out what to do next. Longer-term, this will be looked at as a major inflection point, but unfortunately, we don’t know in which direction. At this point, expect a lot of difficult days ahead but if one thing, you can make a point of noting that the highs continue to get slightly lower. If that’s going to continue to be the pattern, then we are more likely to see the 200 day EMA again than not.