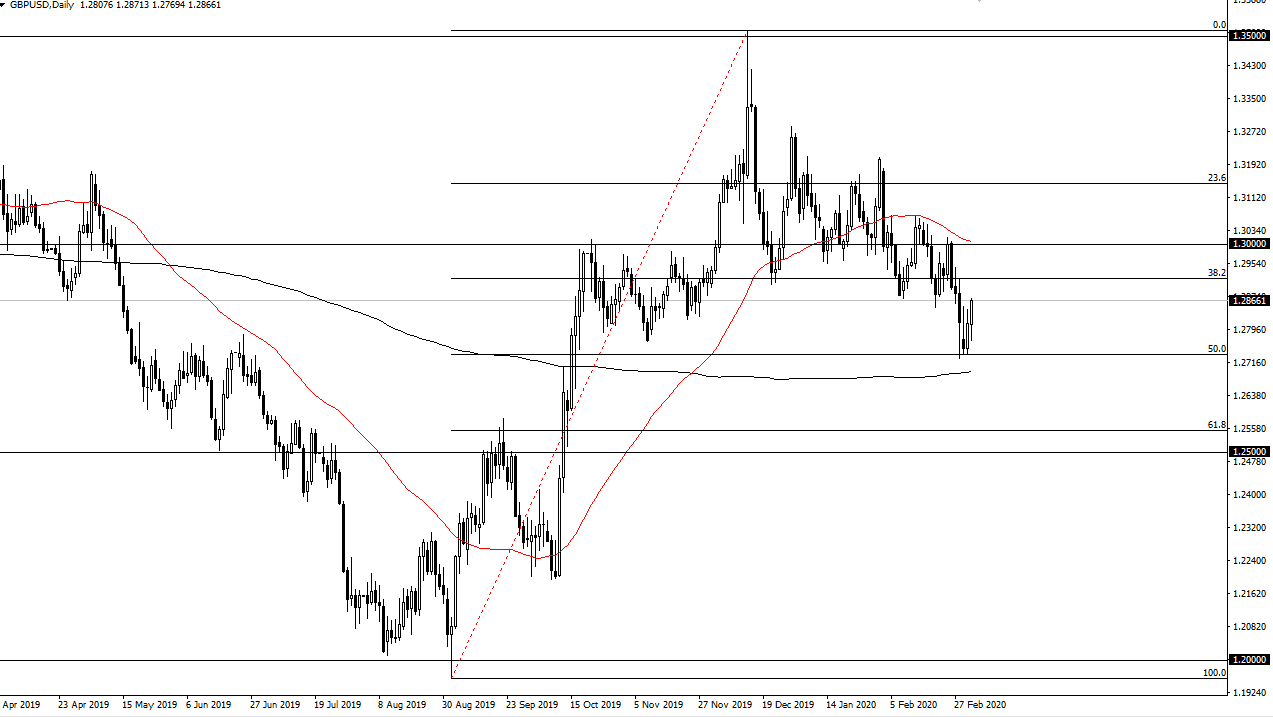

The British pound has initially pulled back during the trading session on Wednesday, but then turned around to rally significantly to show signs of life again. This market closing at the top of the range certainly suggests that we could rally from here further, but the reality is that the market has a lot to choose through above. That being said though, the market has been all over the place recently, as the US dollar is suffering at the hands of potential rate cuts going forward as the market is already pricing in another 50 basis points of rate cuts coming from the Federal Reserve going forward.

At this point, that should continue to work against the value of the US dollar, and it makes sense that the British pound would bounce from here as the Bank of England doesn’t have as much room to cut rates. Ultimately, this is a market that is probably going to continue to be very noisy, but it certainly looks as if the 200 day EMA is coming into pick up the British pound at this point. Furthermore, the 50% Fibonacci retracement level is just below and that also helps the markets in general. With that being the case, the daily chart does look as if it is showing signs of strength, and I would also point out that the last couple of candlesticks have shown wicks to the upside that have been cleared.

Hourly chart reaching towards resistance

The hourly chart has rallied significantly during the trading session on Wednesday as well, but at this point it looks as if there is a little bit of noise right around the 1.29 level above, and at this point we need to break above there to have a bit of continuation. However, if we do that then I believe the British pound probably goes looking towards the 1.30 level. Again, this comes down to the US dollar and rate cuts going forward, not so much the idea of owning the British pound. The 50 hour EMA is starting to curl up underneath to the upside, and I believe that the 1.28 level is going to offer support, assuming that the buyers continue to come back. I think it is going to be a bit difficult to get to the upside from here, but at this point it looks as if we are most certainly in the process of trying to build a bit of a base.