Gold markets initially tried to rally during the trading session on Wednesday, after initially gapping below the $1650 level. It currently looks as if on shorter-term charts that the $1640 level offers support, so the fact that we have bounced from there initially wasn’t a huge surprise. However, you can see that we are plainly sold off from that bounce and now it looks like we are probably going to continue to see a lot of weakness. This is a bit counterintuitive to newer traders, but there is a whole slew of reasons why we may continue to see negative pressure on the gold market, at least in the short term.

Gold markets are often used for a safety trade, but at this point there are other things to take into account. While many traders will jump into gold for a way to avoid damage, the reality is that it quite often is used as a hedge for inflation. Although central banks are likely to continue doing as much as they can to loosen monetary policy, the reason gold will rally in that situation is fear of inflation. However, there are absolutely no signs of inflation anywhere to be found globally. In fact, inflation seems to be dropping more than anything else, which is negative for gold. In this sense, we have a bit of a “push pull” when it comes to this market, as people will look for it to protect against losses. However, at the same time with no inflation anywhere to be seen, there’s no reason to think that it should rise. In other words, we are in a very unique position as gold simply has a mass of fundamentals pushing it in both directions.

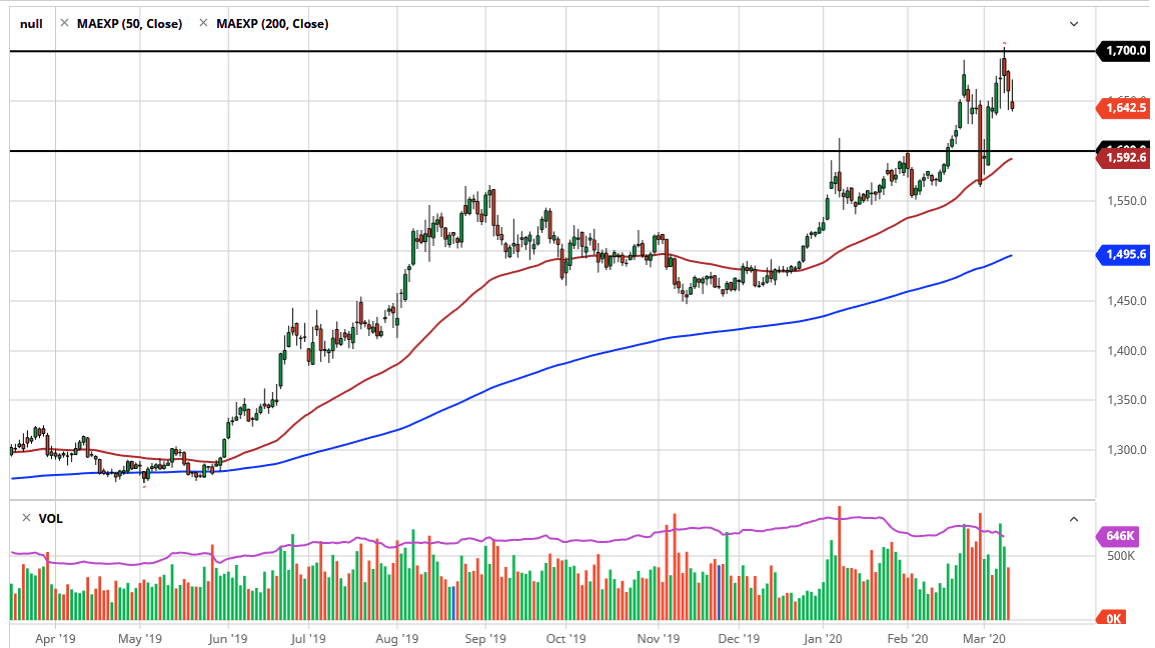

Looking at this chart, the $1600 level underneath should be supportive, as the 50 day EMA reaches towards it. Based upon the shape of the candlestick for the trading session on Wednesday, I do believe that’s where we are going to go given enough time. Furthermore, the silver markets also look very similar so I think that this will be a general move against metals. I don’t necessarily think that we are going to break down below there easily, but it certainly looks as if it is going to be testing that area relatively soon. On a breakdown below the $1635 level it’s likely that the market opens the trapdoor for that move.