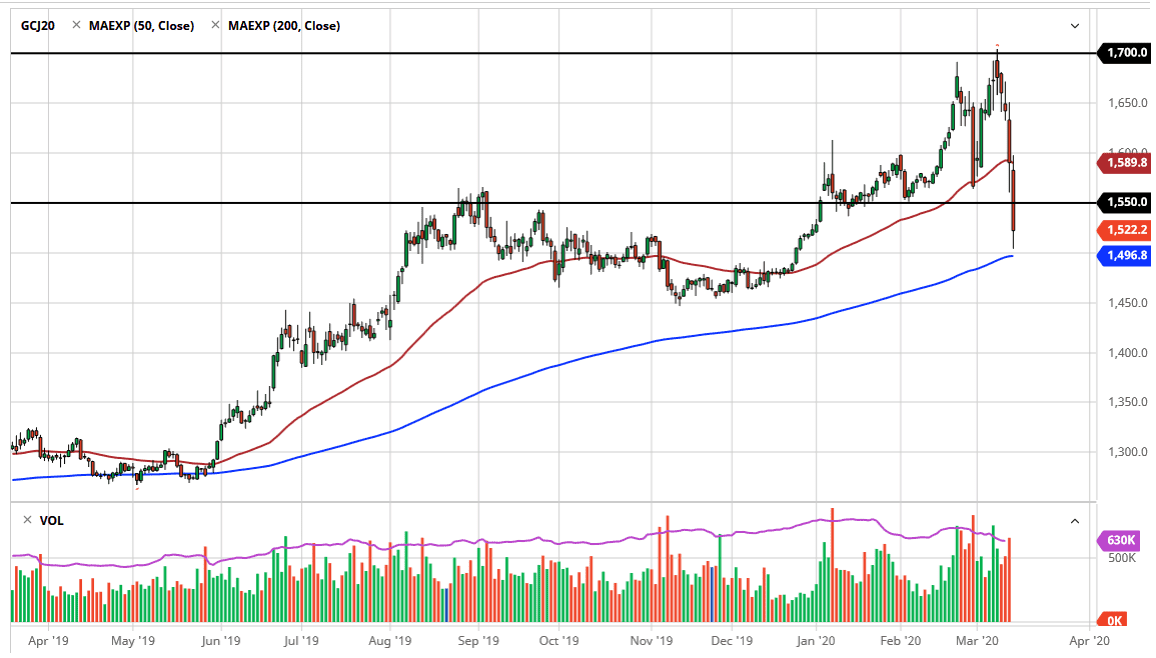

The gold markets have fallen significantly during the trading session on Friday, after initially gapping lower. The market found the 50 day EMA to be a bit too resistive to continue going higher, as it was backed by not only that technical indicator but the $1600 level as well. The market then broke down below support underneath that I thought would hold it $1550 level, showing just how out of kilter things have gotten. By the end of the day, the gold market seems hell-bent on testing the 200 day EMA which is currently just below the psychologically and structurally important $1500 level.

At this point, gold is being sold off due to the fact that traders are having to cover losses in other markets. The massive margin calls that we have seen in other markets. As they sell gold to capture some gains in order to cover those horrific losses. At this point, gold is sitting just above the 200 day EMA and that will attract a certain amount of attention due to the fact that it also is the $1500 level. I think it is very possible that we will find some type of support in this general vicinity.

If the market does bounce from here, I think that the $1550 level will be a significant amount of resistance as it was previous support. In other words, I think the first move to the upside will probably be a relief rally more than anything else. Having said all of that, the market is waiting to see what the governments around the world will do over the weekend, and that could greatly influence what happens next with precious metals. On a daily close above the $1550 level, then you could start to make an argument for buying it.

Ultimately, if we break down below the 200 day EMA it’s likely that the market could go down to the $1450 level. That is an area that was supportive in the past, and if that gives way then gold is going to collapse. All things being equal, I do think that gold will be a massive buy-and-hold scenario, but we aren’t there yet so by all means I believe that the rallies will continue to be looked at as opportunities to fade the market again. Until the stock markets stabilize, it’s probably going to be difficult for gold to do the same.