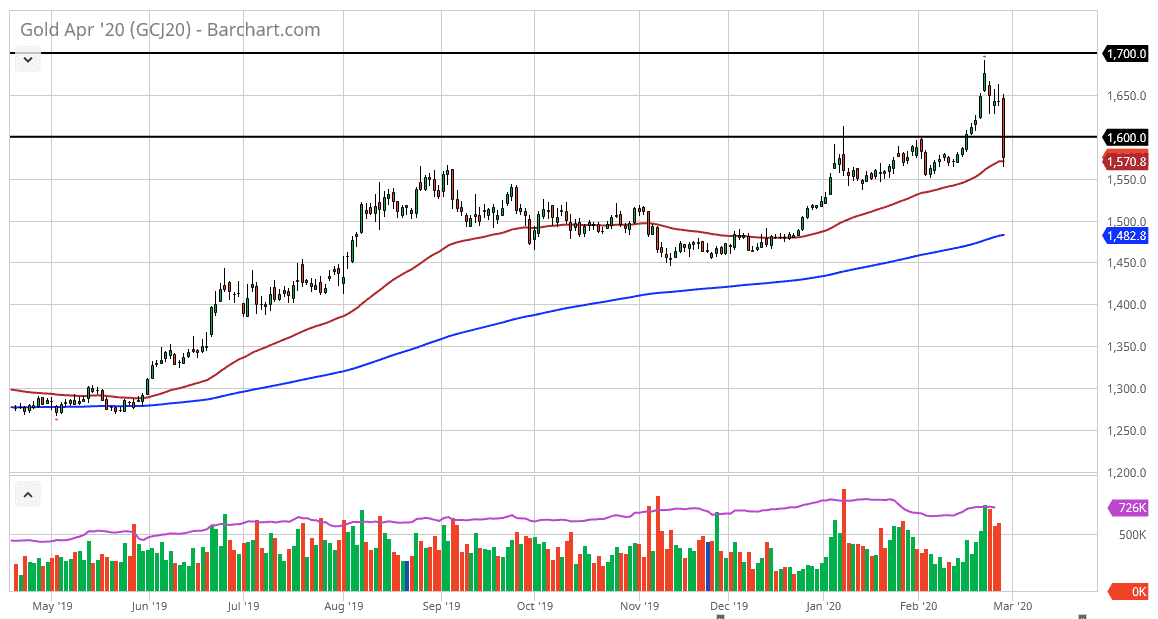

The gold markets have broken down significantly during the trading session on Friday, as forced liquidations hit various parts of the markets over the previous week. The gold markets were very much in profit for most traders, and therefore they felt compelled to close the positions in order to move that money to cover losing positions. Furthermore, the market could have been a little bit of her stretched, and as the $1700 level is a large, round, psychologically significant figure, it makes sense that a pullback came. However, was a bit surprised at the $1600 level was sliced through so quickly on Friday.

The 50 day EMA is starting to make its presence known, so we could get a little bit of support there, and most certainly the $1550 level underneath will be. If we do break down below that level, then the market could go down to the $1500 level which is starting to attract the 200 day EMA. It will be interesting to see what happens next with gold, because the weekend will almost certainly have a lot of headlines coming out about the coronavirus and more than likely central banks as well. It’s very likely that the server banks will do something in order to support the markets, and we could even see a coordinated effort. If that’s the case, we could get a bit of a boost for gold as monetary policy getting even looser around the world should longer-term help out this market.

If we don’t get that, then it’s likely that the market will continue to break down a bit, but I do think that the $1500 level will offer enough support to keep the market somewhat levitated. The 200 day EMA getting broken to the downside would be rather negative, and that could change the trend overall. At this point though, it’s very likely that the gold markets will continue to grind higher as they had been strong for some time, and of course my longer-term technical analysis suggested that we were going to go to the $1800 level anyway. One thing is for sure, the Monday opening is going to be extraordinarily volatile and therefore keeping your position size small is going to be crucial. If the market can retake the $1600 level, that would be a very bullish sign, just as the pullback and a bounce from the $1500 level would be.