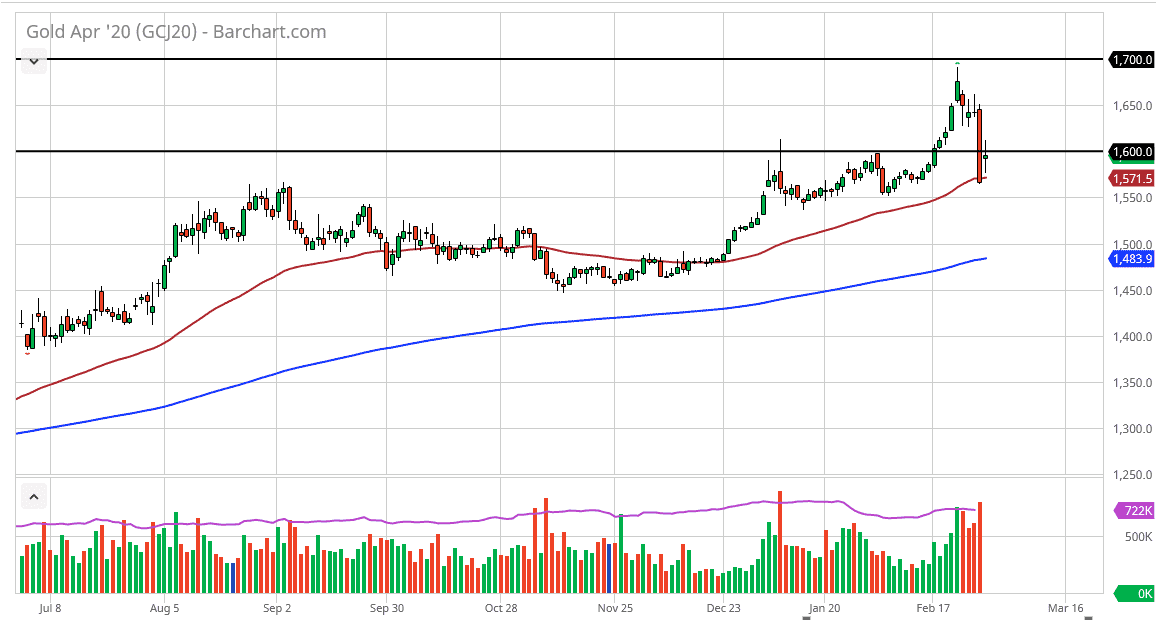

The gold markets gapped higher to kick off the trading session during the day on Monday, broke above $1600, and then pulled back towards the 50 day EMA. The 50 day EMA should offer a bit of dynamic support, and at this point it will be interesting to see how this plays out. The neutral candlestick after such a negative candlestick suggest that we could turn around and go to the upside but given enough time it’s likely that we will have to make a major decision. If we can break above the top of the candlestick it’s likely that the market will go looking towards the $1650 level. Beyond their, the gold market then goes looking towards the $1700 level.

That being said, the market is very likely to have to make some type of decision in the short term, as we have so much in the way of economic concerns right now. The G7 are going to have a conference call during the trading session on Tuesday that will certainly have an effect on central bank commentary, perhaps even central bank monetary policy. If it continues to be loose that should help gold, and I think that might be part of what we are going to be paying attention to.

The market did pull back a little bit during the trading session though, as there was more of a “risk on” sentiment in the stock markets. I think at this point we could see a return to stock markets higher, right along with gold rising. However, the collapse on Friday is rather negative, so if we were to turn around a break down below the $1550 level, it’s likely that the market then goes down to the $1500 level. That is an area that also features the 200 day EMA, but it is also a large, round, psychologically significant figure. I think at this point it is very difficult to make an assumption, other than the fact that the market has been trending much higher. At this point, it’s a bit early to say that trend has changed, so I do favor the upside move and it is most certainly much easier to handle. Indecision after a gap higher does show signs of stability, so that is a good sign, but again all it will take is a couple of stupid comments out of members of the G7 to further things back into chaos.