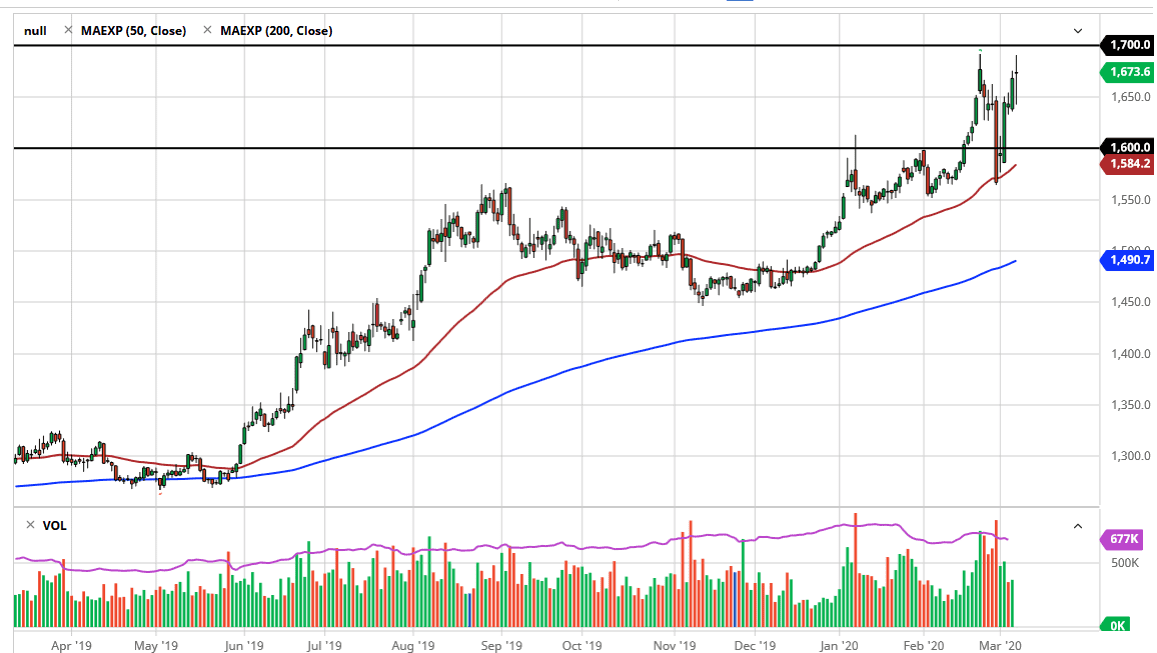

Gold markets went back and forth during the trading session on Friday, showing signs of noise and confusion. That being said, the market is certainly looking likely to try to build up enough pressure to break out, and if we can clear the $1700 level on a daily close, then it’s very likely that we go much higher. If that does in fact happen, it’s likely that the $1800 level will be a target over the longer term.

Gold has gotten a bit of a boost due to the fact that the US dollar has been hit, after the Federal Reserve did a 50 basis point cut in the middle the week. Furthermore, the Fed Funds Rate futures suggest that there is another 50 basis points ready to be cut, and we have learned over the last decade or so that the Federal Reserve will do what Wall Street tells it to do. In other words, it’s very likely that the gold markets will go higher due to the fact that the US dollar will continue to lose strength. Quite frankly, that’s not a huge stretch though, considering that the US dollar had been so overbought.

At this point, I see several technical levels on this chart that could function as support, with the most obvious one being the $1650 level due to the fact that it already has offered that support. Ultimately, if we break down below there then it’s likely that the market goes looking towards the $1600 level. That’s an area that should be supportive as well, as the 50 day EMA is sitting just below. This is a market that has been strong for quite a while but may need to build up the necessary momentum to finally break out to the upside.

At this point, it’s very likely that the gold markets will be noisy, just as the US dollar is. However, there are enough things out there to continue to see this market be in demand as central banks around the world continue to loosen monetary policy. At this point, I have no interest in trying to short the gold market, because quite frankly it is far too strong to fight. That doesn’t mean that we will get the occasional pullback, but that should continue to be a “buy on the dips” mentality that you are seeing on the charts. I don’t see anything changing anytime soon.