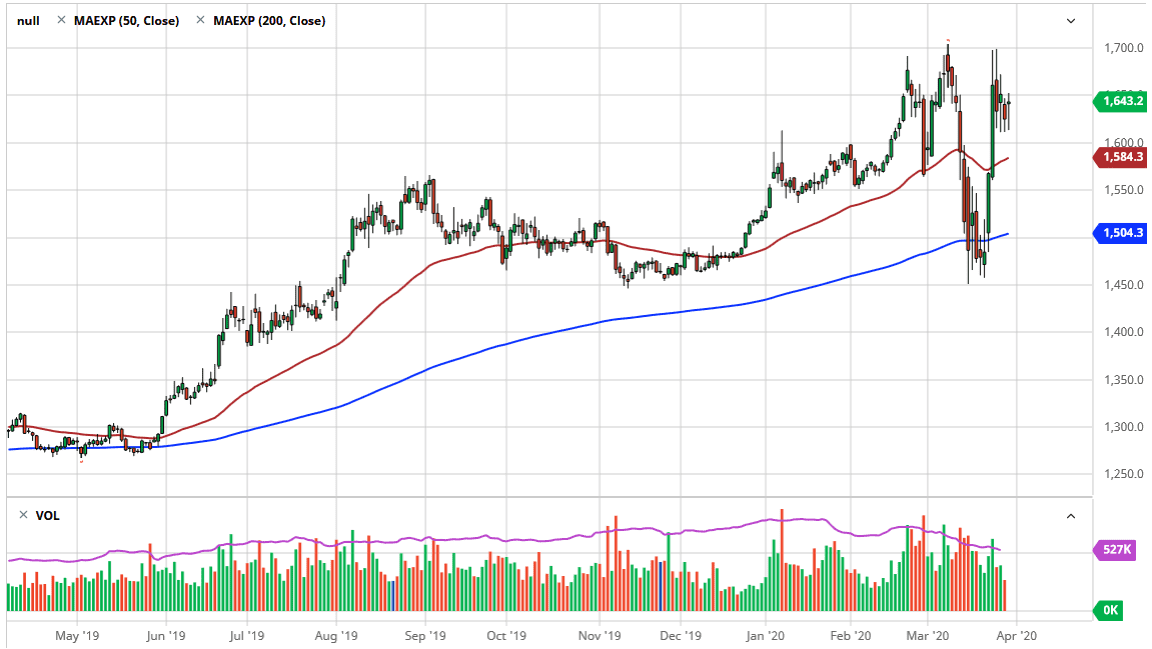

Gold markets have gone back and forth during the trading session on Monday, showing signs of noise. At this point I think that the market will continue to see the $1650 level as resistance, and if we can break above there it’s likely that the market will then try to go to the upside. At that point I would anticipate that the market goes looking towards the $1700 level, an area that has caused a bit of resistance more than once. If we break above that, then we can continue the longer-term uptrend towards the $1800 level, finally then focusing on the $2000 level which is my longest term target.

Looking at this chart, if we were to break down below the $1600 level, it’s possible that the market could go down to the 200 day EMA at $1500. All things being equal, the market is a bit overextended but the one thing that I do like about gold is that we have just been hanging around at these highly elevated levels. This tells me the market is getting used to being up here, thereby giving the appearance of a market that is building up the necessary momentum or perhaps just “killing time” at these higher levels. I have no interest in shorting gold until we break down below the lows of the last swing low, closer to the $1450 level, something that doesn’t look very likely to happen here.

Beyond that, central banks around the world continue to flood the world with fiat currency, not the least of which would be the Federal Reserve, as the market is extraordinarily flooded with greenbacks all of the sudden. Ultimately, the market still looks very positive from what I see, and certainly there are more than enough reasons out there to think that there could be a bit of a safe haven bid relatively soon. Between that and central bank monetary policy, it’s difficult to get negative on precious metals, especially gold. If you don’t like being fully exposed to the precious metals, you can do a “pairs trades” between gold and silver, buying gold in selling silver to pocket the difference in momentum. At this point, I just don’t see how this market falls and I believe that gold will continue to be very bullish going forward. The conditions are just about perfect, give it enough time. Inflation will be an issue, at least not yet but once it takes off it’s over.