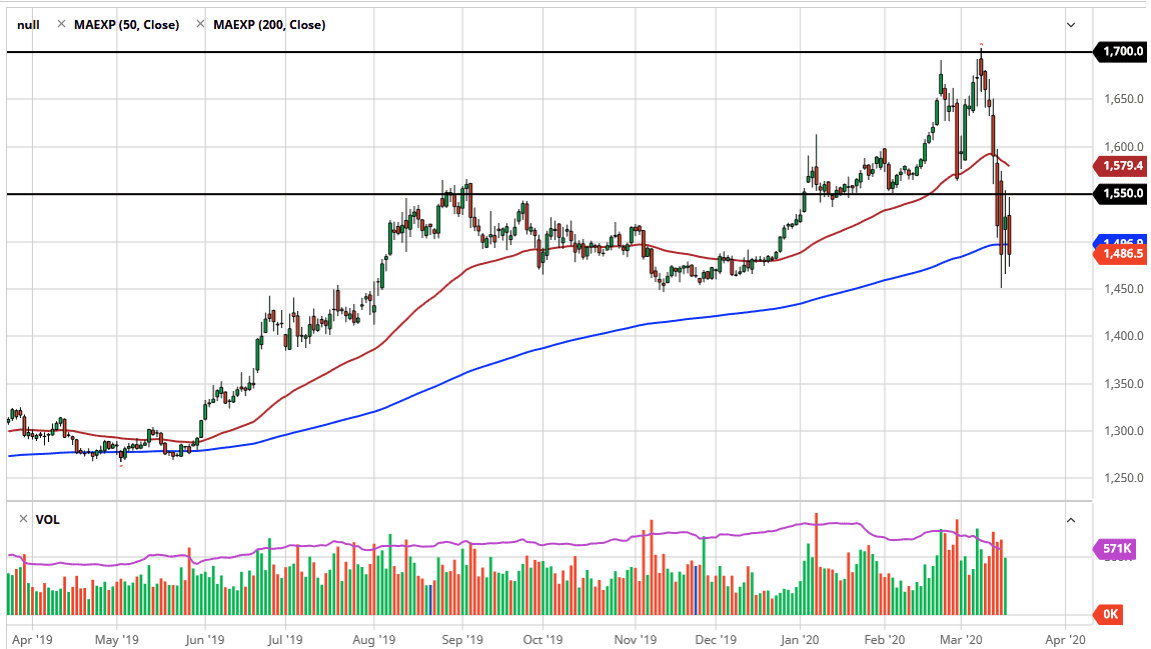

The gold markets went back and forth during the trading session on Wednesday, as we continue to bounce around the 200 day EMA. That of course is a large indicator for trend followers, so they do pay quite a bit of attention to it. The $1500 level of course is an area that people will pay significant attention to due to the fact that it is a large, round, psychologically significant figure. To the upside, the $1550 level has been offering resistance so if we can break above that it would be a good sign. At that point in time I would anticipate the $1600 level be targeted next.

Gold has been sold off even though there has been a major amount of fear the market, due to the fact that the global market is obviously slowing down. At this point, the gold market has been sold off in order to cover losses in other places and I think that continues to be a theme that we could see going forward. All things being equal, this is a market that should continue to be very noisy, and erratic to say the least. Ultimately, this is a market that is going to offer value given enough time but obviously we still have a lot of concerns out there and possible forced liquidation ahead of us.

Currently, the $1450 level offers a significant amount of support, as we have seen the market bounce from there are a couple of times. At this point though, if the market was to break down below that level it opens up the door down to the $1400 level. A breakdown below that level would be even more interesting. Having said that, I do think that we are more than likely to see buyers on dips as gold should offer plenty of value for those who are willing to take advantage of what is essentially gold “on sale.” I have no interest in trying to get cute at this point, but I do recognize that building up a larger position in small bits and pieces might be the best way to trade this market going forward. At this point, I believe that waiting until we break out of this $100 range is probably the safest way to deal with the market. Overall, though, if you are shorter-term trader you can look at this as a range bound trading opportunity.