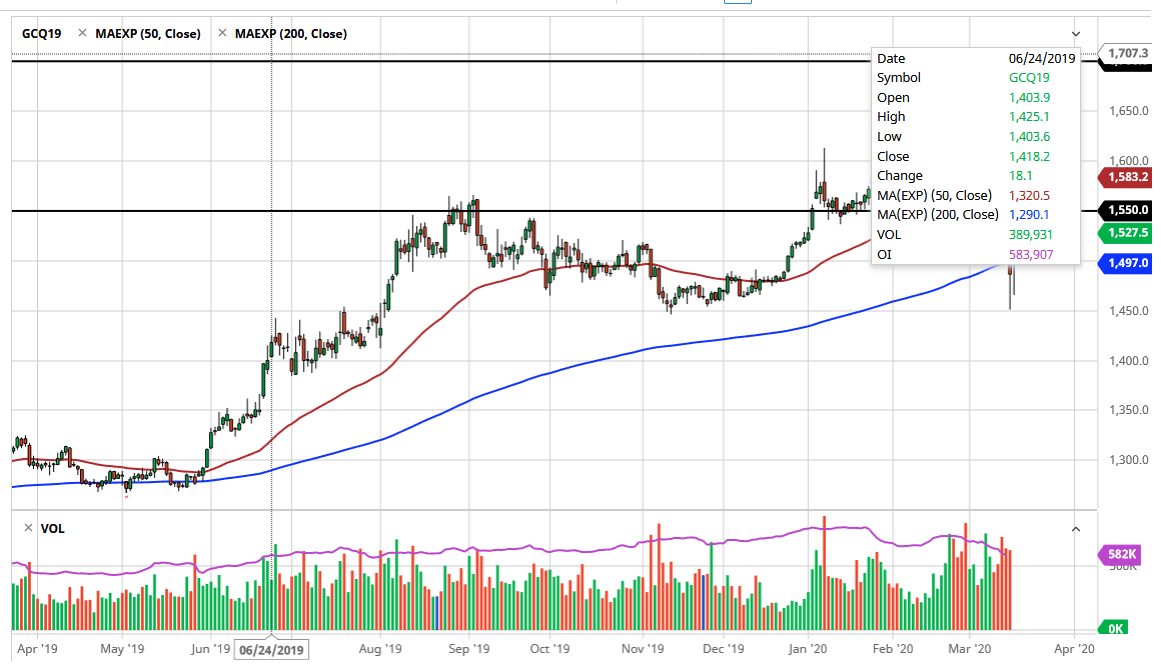

Gold markets went back and forth during the training session on Tuesday, using the 200 day EMA as a supportive indicator. The 200 day EMA holding is crucial, as quite often traders will use it as a longer-term trend of finding indicator itself. At this point, the market looks as if it is ready to rally from here and therefore, I like the idea of buying gold, but I also recognize that the volatility is probably going to be a major issue in general. Beyond that, gold has suffered at the hands of forced liquidation more than anything else, meaning that traders have had to sell it in order to raise funds for positions that are struggling in other markets. By extension, this means that people still like gold, they just had to sell it, didn’t want to sell it which is a lot different.

The $1500 level offering support right at the 200 day EMA makes quite a bit of sense as I mentioned yesterday, so now I believe that the buyers are going to step in, and this is especially true if we continue to go sideways. In fact, the best thing that we can see is gold going sideways for a few sessions before breaking out to the upside. Rallies tend to be slower and steadier moving affairs, so you need stability for them to happen.

It’s very likely that gold will eventually go looking towards the highs again, at the $1700 level. I also believe that we will eventually break above there, considering that the central banks around the world continue to cut interest rates, and of course had plenty of stimulus to the markets. Pullbacks at this point in time are going to continue to be longer-term buying opportunities but that doesn’t mean we can’t drop from here. Keep in mind that the global situation is extraordinarily volatile, and that of course has its influence on gold to begin with. I do think though that longer-term we are going to see a lot of bullish pressure to the gold market, but you may have to be willing to deal with a lot of noise between now and then. Adding slowly is probably the best way to go, building up a larger core position as central banks are going to be at zero interest rates for the foreseeable future, which typically does well for gold.