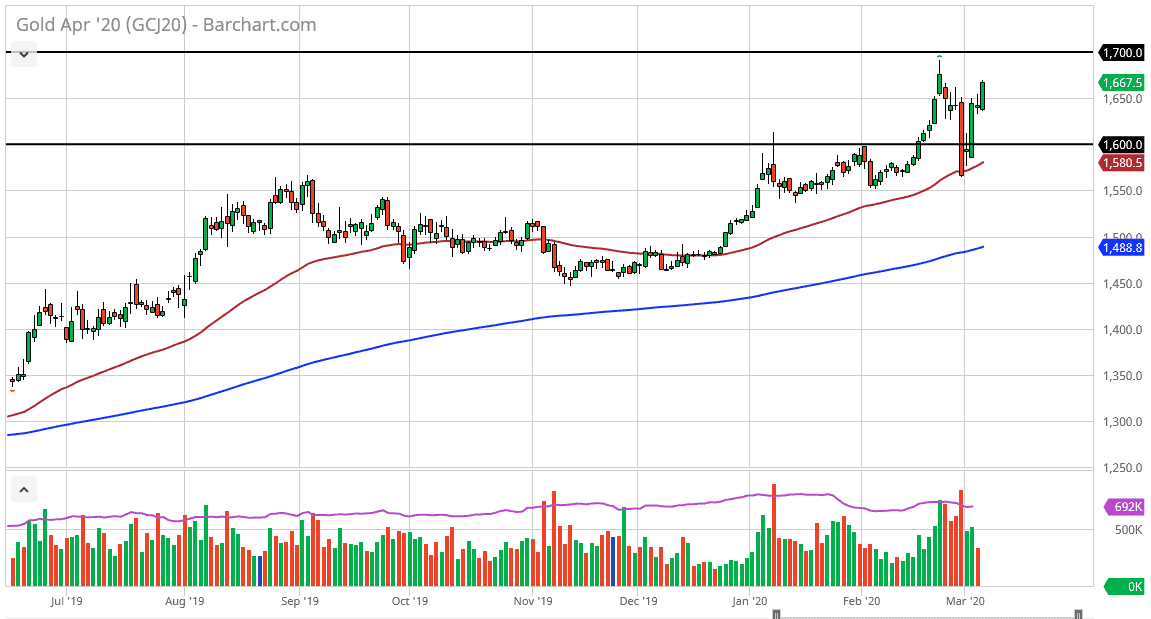

Gold markets look extraordinarily bullish heading into the jobs figure on Friday, breaking above the $1650 level without much hesitation. This of course is a sign that perhaps traders are starting to worry about the markets in general, and this should continue to push the market towards the all-important $1700 level. The candlestick is very large in relation to the previous one and it looks as if we are going to close towards the top of it. Because of this, I anticipate that we will see continued upward pressure but obviously we have the jobs figure to worry about and that of course comes into play as well.

To the downside I believe that the candlestick from the previous session suggests a certain amount of support, and therefore I think that when we are looking at the gold market, and from the short term standpoint a lot of traders will be paying attention to the area right around $1640 or so.

Hourly chart shows big breakout

The hourly chart has shown a big breakout, and you could even make an argument for the idea of a bit of a “inverse head and shoulders”, although I’m the first person to admit that it is a little bit of a stretch. That being said, the 50 EMA on the hourly chart has offered nice support as of late and it looks as if we are going to go looking towards the $1675 level. Above there, the market then search look at that crucial $1700 level that had turned things back around. Pullbacks at this point should continue to offer a buying opportunity and I do think that a lot of traders will be looking for bits and pieces of value underneath the take advantage of. Keep in mind that gold will move with risk appetite, gaining as people become more concerned about global gyrations in economies and of course interest rates being cut by central banks around the world will continue to drive money out of Fiat and into hard assets such as gold. A breakout above the $1700 level should open up the possibility of a move all the way out to the $1800 level, something that I’ve been looking for on a longer-term basis anyway. At this point, I have no interest whatsoever in trying to short this market as it has far too much in the way of concern to think that gold will be sold off.