The gold market had rallied initially during the open on Monday, as the Federal Reserve surprised the world by cutting interest rates by 100 basis points. By doing so, it sent the markets into disarray as people are trying to figure out what happens next. If very quickly, we started to see forced selling in the gold market, due to the fact that it was one of the few places that has shown strength. Those gains are sold so that traders can cover losses in other markets. How long this goes on, it’s difficult to know but it does seem as if it is starting to reach a bit of a fever pitch now, which is generally a sign that you are getting closer to the end.

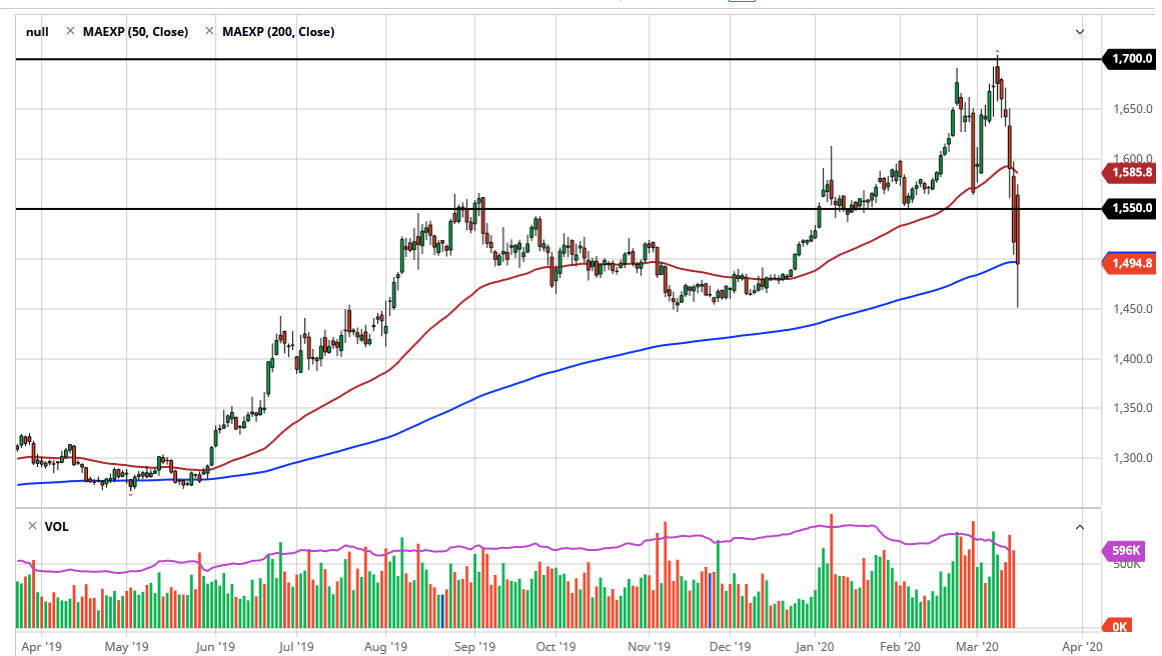

The market breaking through the 200 day EMA was a very big deal, but it is also a very big deal to see that the market is trying to recapture that level. If in fact it does, it could signal that we are getting extraordinarily close to the bottom. The $1450 level has caused quite a bit of support a couple of times in the past, so if it does end up being supported now, that could be a good sign as well. Adding more influence to this area is the fact that the $1500 level is sitting just above that 200 day EMA.

The gold market recapturing the $1500 level would be a good sign and I think at that point a lot of value hunters will get back in. After all, there are plenty of things out there to be concerned about so gold should still continue to get a bit of a bid.

On the flipside, there is absolutely no inflation out there so central bank quantitative easing probably will drive gold up in the short term. This is more of a longer-term situation as destruction happens quite quickly, but rallies tend to grind away to the upside. I think that’s what we are going to see here given enough time, and I believe at this point it’s difficult to sell gold after a tad this type of massive move. Because of this, I’m looking for bounces to take advantage of. For those of you who are little bit more risk averse, you may need to see a daily candlestick that is just a touch more supportive than the one we are printing before going long.