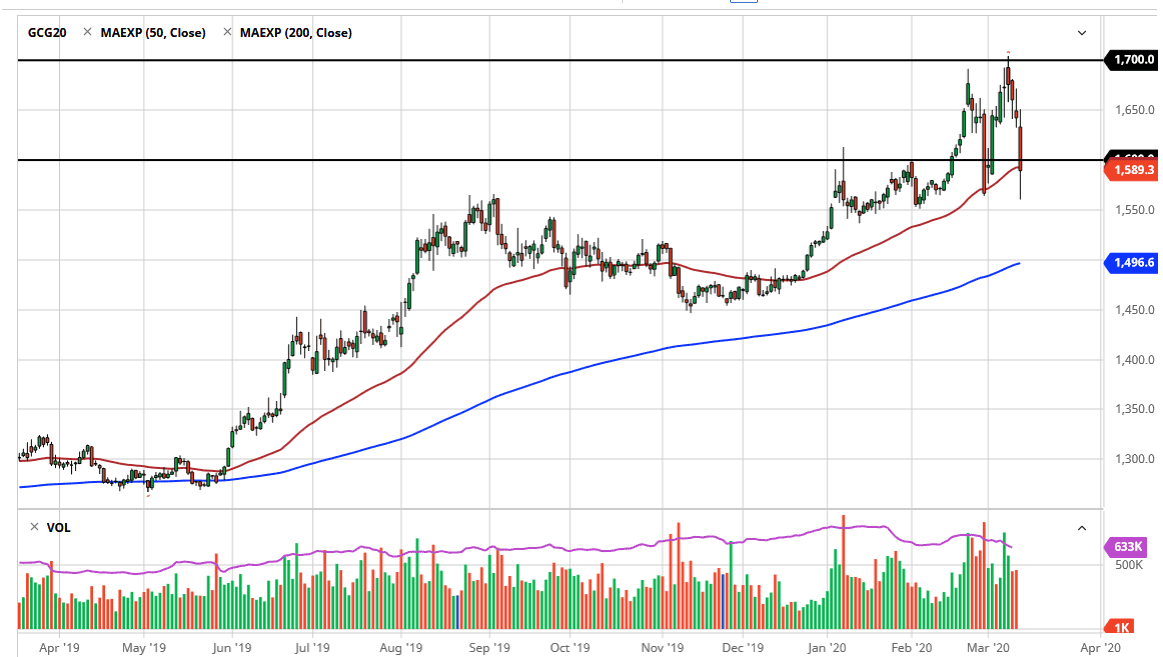

Gold markets initially tried to rally on Thursday, reaching towards the $1550 level, before bouncing slightly at the end of the session. At this point, the $1600 level is crucial, and if we can get above there on a daily close for Friday, that could be a sign that we are going to go back into the range that we have been in, and therefore it’s likely that we could see more choppiness. However, if we were to drop down below the $1550 level, it’s likely that we go down to the 200 day EMA at the $1500 level.

Looking at this candlestick, it is obvious that there was a lot of panic selling during the trading session, but this may have been more or less in a bid to raise liquidity for positions that are falling apart. Ultimately, it’s probably best to buy this market after a daily close, so therefore I’d be cautious about jumping into this market heading into the weekend. This is because gold is not only going to be a “safety bid” in certain circumstances but it will also be a funding currency in the sense that people have been making money in this market and they need to cover the drastic loss as they are having in other places.

Furthermore, even though central banks around the world continue to liquefy the markets and cut rates, etc., the gold markets aren’t reacting in the normal favorable way, because inflation isn’t coming anytime soon. Without inflation, it’s very unlikely that the gold markets will take off with any type of significance. Short-term trading opportunities may present themselves during the day on Friday using $1550 level as a bit of a floor, but at this point it’s best to let the market stabilize themselves before risking too much. If you do have the need to gamble in this type of situation, I urge you to use very small positions as somebody who survived the 2008 meltdown, I can tell you that the gains are nowhere near as important as protecting your losses. Gold is a thin market, despite what many of you may think, and therefore should be treated with caution. Some of the institutional spreads that I have seen during the trading session on Thursday have been extraordinarily wide, which is not a good environment for the retail trader to be involved in. Wait till we close on Friday and we should have a bit more clarity.