Gold markets initially tried to rally after gapping lower on Wednesday, only to see the $1650 level offer resistance yet again in the forward futures contract. That being said, we have seen a significant amount of volatility in the gold markets, right along with the rest of the world. The Wednesday session was probably a welcome change of pace for most traders, as the volatility has been extreme.

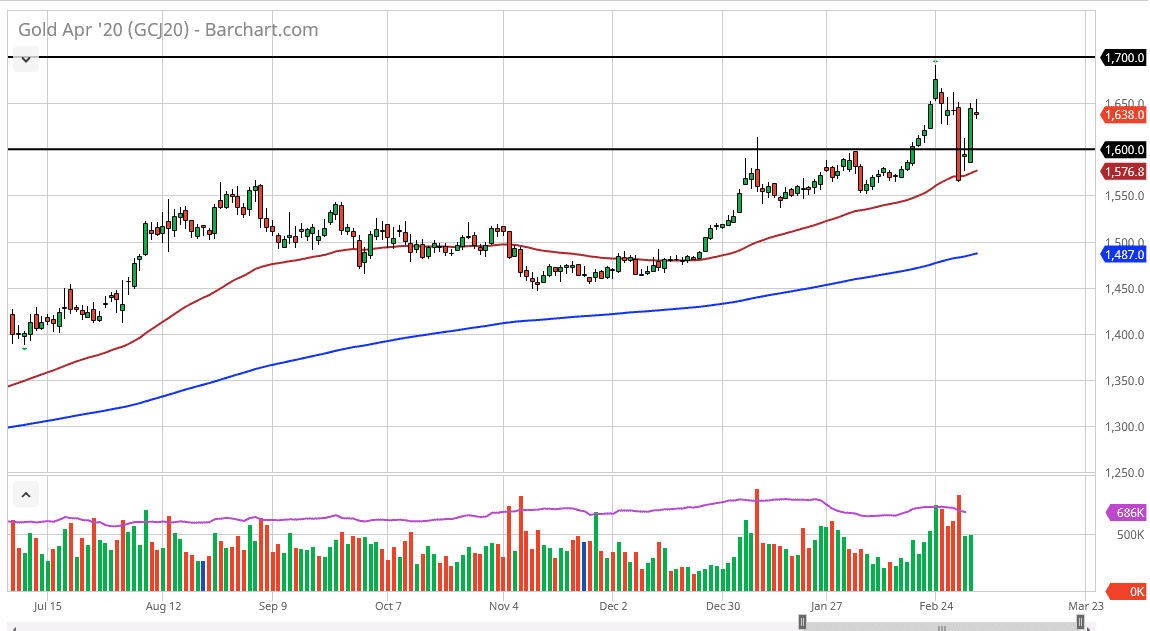

As the daily chart shows, the 50 day EMA has of course come into play as support recently and it should continue to attract a lot of attention. Ultimately, this is a market that continues to be very difficult to deal with although it has a decided upward tilt in general. The $1600 level should offer a lot of support as it previously had been significant resistance. That is an area where I would fully anticipate traders to come back into the marketplace and try to take advantage of “cheap gold.” That being said, we may have a slightly negative session during the trading day on Thursday. However, we have the jobs number on Friday and that of course can move markets quite rapidly. On the other hand, if we were to break above the top of the candlestick for Wednesday, it would be a very bullish sign and could send traders looking towards the $1700 level.

Hourly chart forming ascending triangle

The hourly chart has just seen the 50 EMA cross over the 200 EMA and has been grinding sideways for the last couple of sessions. However, it looks as if the market is trying to form a bit of an ascending triangle and therefore, we may be getting ready to see a bit of upward momentum come back into play. If that’s going to be the case it’s very likely that the gold market will break towards the $1660 level in the short term, possibly even as high as the $1700 level as shown on the daily chart. To the downside short-term traders will look to the $1625 level for support, and most certainly the $1600 level after that.

Any break below the $1600 level will start to bring in much more selling and could send this market much lower in a relatively quick manner. That being said, I believe that pullbacks will continue to be bought over the next couple of days and Thursday may find itself be more or less an opportunity for people to pick up value.