The US dollar returned to a new high during yesterday's trading session, following suggestions from US President Trump and his team to prepare for plans to stimulate the US economy in light of efforts to confront the economic effects of the recent Corona epidemic outbreak in the United States, causing 29 deaths. Optimism from Trump's statements contributed to the American stocks achieving some gains after recent heavy losses, and accordingly, the price of gold fell to the $1641 level, before settling around the $1665 level at the time of writing. In the beginning of this week’s trading, gold prices rose to the $1703 resistance, the highest in seven years. Amid growing fears of the US economy inevitably heading into recession due to Coronavirus paralyzing the global economy.

The Coved 19 epidemic has caused more than 4,000 deaths so far and infected more than 118,000 people, after it spread rapidly in 100 countries around the world since it crossed the Chinese borders. Concern about the spread of the epidemic was a reason for the weak travel movement and the suspension of global supply chains. It also contributed to pressure on global central banks to work on easing their monetary policy to face the negative effects of this epidemic.

Now that the US Federal Reserve, the Australian Central Bank, and the Bank of Canada have all announced lower-interest rates, focus is now heading towards the Bank of England and the European Central Bank. From Britain, the important budget details will be announced today, amid expectations of a surprising intervention from the BoE today as well. On the other hand, expectations increased that the ECB officials will announce more monetary incentives when they meet tomorrow, Thursday, including lowering interest rates as well as corporate bond purchases that aim to support commercial borrowing. The European Commission said it plans to provide existing financing for the creation of a 25 billion Euro (28 billion dollar) investment fund to support the Healthcare system, companies and labor market measures.

These measures did not prevent gold investors from sticking to it as a safe haven as long as there is no vaccine to eliminate the Coronavirus.

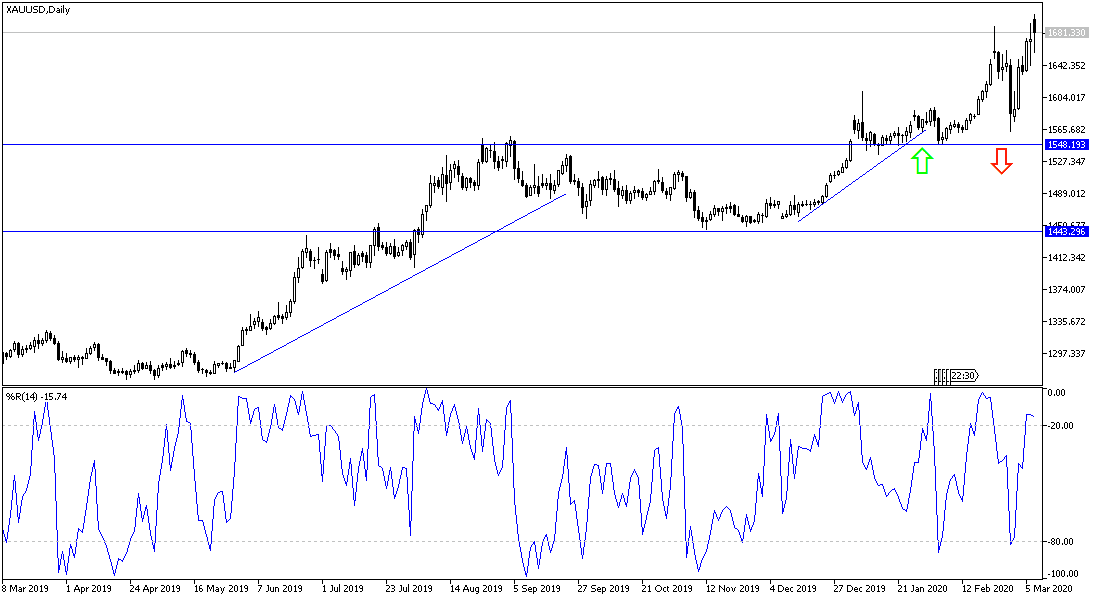

According to gold’s technical analysis: I still stick to the strategy buying gold from every low level, and the closest support levels are currently at 1648, 1635 and 1620, respectively. The persistence of Coronavirus fears and the continued global financial markets collapse, may prompt push gold prices higher beyond the $1700 psychological and historical resistance again. At the present time the closest resistance levels are 1673, 1685 and 1710, respectively. Gold price will react today with the announcement of Britain's budget details and US inflation figures.