The NASDAQ 100 gapped lower just like everything else did during the trading session on Monday as traders came out shorting right away. There is a major price shock in the oil markets as Saudi Arabia has decided to flood the markets with supply in order to bring prices down and drive US producers out of business. They were also looking at the Russians, due to the fact that Russia refused to cut production as well. That being the case, it was yet another thing that drove the Saudis into a price war.

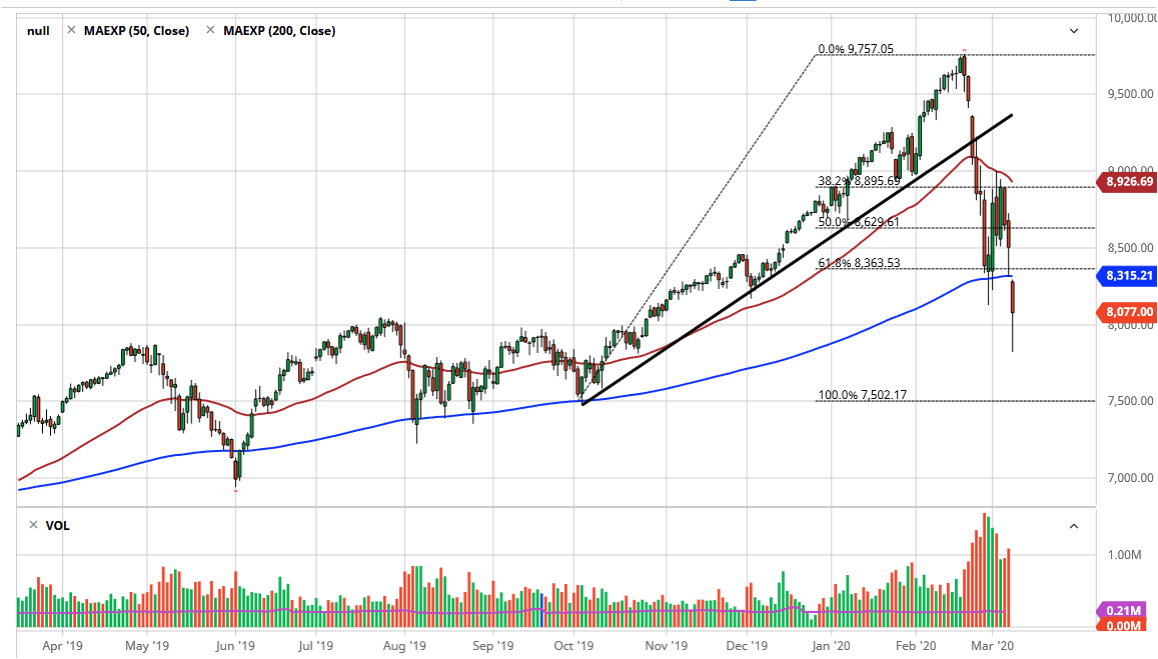

That being said, the gap also features the 200 day EMA so that could cause some resistance, just as the 8500 level will be. The 8500 level will offer a significant amount of psychological resistance as well as resistance based upon the candlestick from the previous session. Overall, this is a market that does look like it’s trying to pick up a little bit of its momentum to the upside, but it’s very likely that rallies will be sold into. After all, the issues that have plagued the markets are still most certainly out there, and therefore it’s likely that any rally will be short-lived at best. I do believe that it’s only a matter of time before we break down even further, perhaps reaching down to the 100% Fibonacci retracement level in the form of the 7500 level. Having said that, markets did hit the circuit breaker right away during the day on Monday, and that means that the selling is probably far too exhausted.

Breaking above the 50 day EMA would be a very bullish sign, but it’s difficult to imagine that happening anytime soon unless of course the Federal Reserve steps in and do something to boost the markets. That is very possible but will probably come out after the markets are closed. With that being the case, expect to move to be very sudden and violent as it will probably come in thin trading. The markets are currently waiting to see what the governments around the world are going to do, but it should be noted that the end of the day is closing somewhat positively, given what has happened previously. At this point, the market looks as if it is trying to hold on to the 8000 level but at this point fading rallies should continue to be the way going forward unless we get proper liquidity measures. This will be a day-to-day situation.