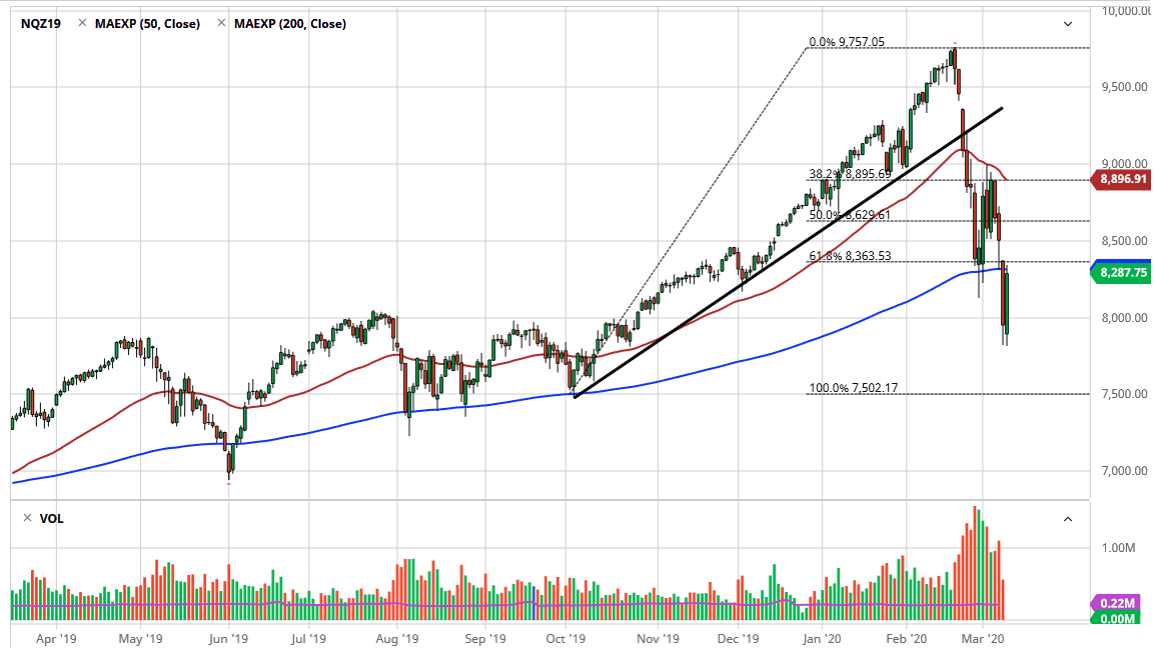

The NASDAQ 100 has rallied significantly during the trading session on Tuesday to wipe out the losses after the gap lower on Monday. However, we have not filled the gap so that is still something that people will be paying attention to. The market is currently hanging about the 200 day EMA, and as a result that is an area where the sellers come back in. In fact, it’s not until we break above the gap that I would become bullish. Even then I would be a bit cautious.

Keep in mind that stock markets are waiting to see what the Federal Reserve will do as far as interest rate cuts, and of course what the US government is going to do as far as fiscal stimulus is concerned. At this point, the market is hoping for a handout, and it will celebrate one. The question at this point is whether or not the market gets enough to make itself jump to the upside.

The 8000 level underneath is crucial and important to pay attention to, so if we were to break down below that level it’s very likely that we unwind and go looking towards the 7500 level next which is the 100% Fibonacci retracement level. That is a level that being broken below would unwind this market even further. Needless to say, this is a market that is very noisy and skittish, and that typically does not lead to higher pricing on the whole. Until something dramatically changes, I am looking to short this market on rallies that show signs of exhaustion.

Keep in mind that the NASDAQ 100 is highly correlated to the Chinese markets and what’s going on in China, so that will have a massive influence on some of the major companies. However, the NASDAQ 100 may do a little bit better than some of the other major indices due to the fact that a lot of the technology companies can function online and through telecommunications much easier than some of the legacy companies. That doesn’t mean that this index will rally, just that it may not be as bad as the S&P 500 overall. That being said, the next couple of days will be crucial as to whether or not this market can find its footing. The gap above still looms large and it’s worth noting that the top of it is right at the 8500 level.