The NASDAQ 100 has broken down during the trading session on Wednesday again, as we continue to see a lot of choppiness and back-and-forth trading. Quite frankly, we are moving on the latest headlines, and right now the market is focused on whether or not the United States government is going to jump in and start doing some type of stimulus package. It’s almost guaranteed action, but the question is how will that look? The markets around the world are demanding the idea of stimulating economies as people will not be moving back and forth if there is a major pandemic which the World Health Organization has just declared the coronavirus to be.

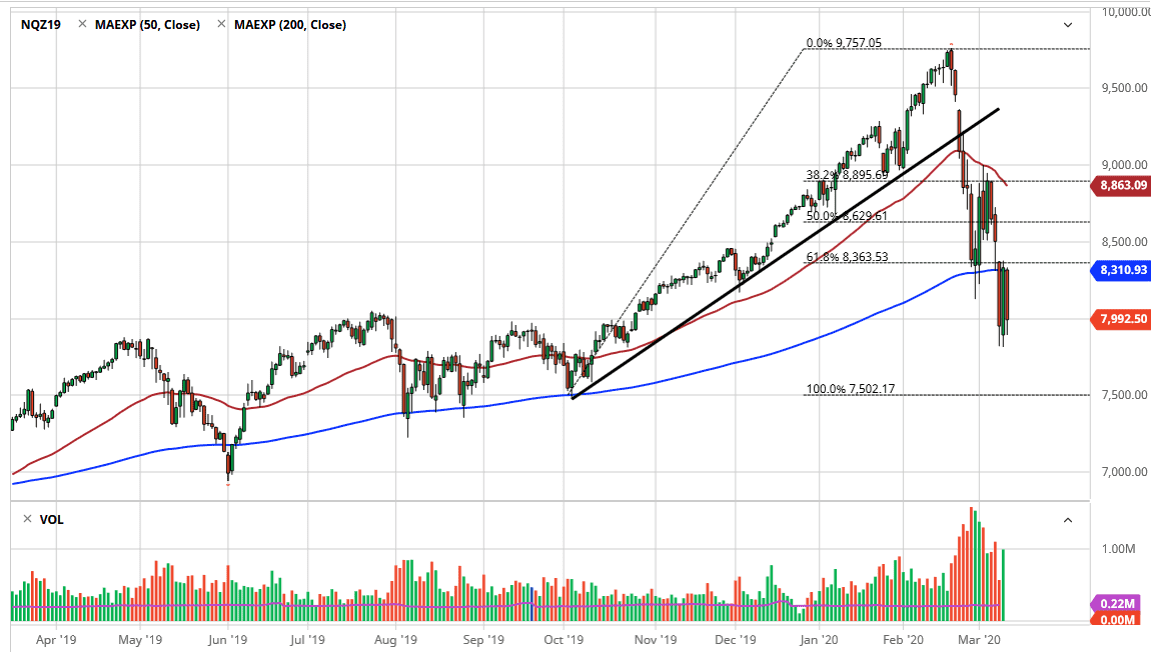

It isn’t necessarily the idea of how many people are going to die, but more along the lines of that people won’t be traveling as much, and that of course going to large gatherings. If the markets are going to continue to see a lot of questions as to whether or not Washington is going to do anything, the volatility will continue. We are literally moving on the latest headline, but it should be noted that the 200 day EMA has offered a bit of resistance in the short term. It also offered support in the past so at this point I think it’s very likely it will continue to be a bit of a focal point.

To the downside, if we break down below the lows earlier this week, I think at that point we will finally move towards the 7500 level, an area that would define itself as the 100% Fibonacci retracement level. Beyond being the 100% Fibonacci retracement level, it is a large, round, psychologically significant figure. Ultimately, a break down below that would open up the “trapdoor” to send this market much lower. At that point, I anticipate that the selling will accelerate rapidly, and that could cause a lot of issues. Because of the volatility that we have seen as of late, don’t be surprised at all if something is said that causes a little bit of a bounce but it’s obvious that bounces are to be sold into as markets continue to crater in general. Credit markets are starting to become a problem two, and therefore they should be paid attention to also. I have no interest in buying this market, at least not until it proves itself. Right now, every time somebody tries to step in and buy, they get their head handed to them.