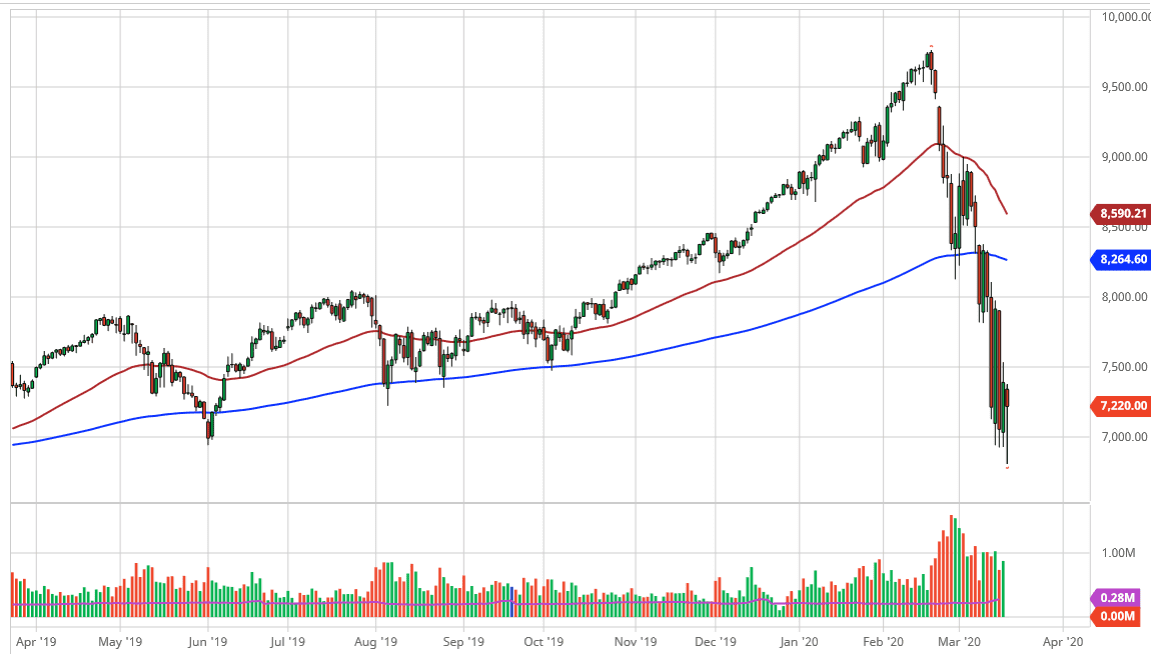

The NASDAQ 100 has had a wild ride during the trading session on Wednesday, breaking below the 7000 level before turning around and forming a hammer. In fact, the last hour of trading during Wednesday was extraordinarily bullish, bringing value hunters into the marketplace to take advantage of what has been an oversold market. As people are looking for cheap stocks. Furthermore, there have been short sellers that probably are willing to take advantage of the gains and simply cash out.

The 7000 level has been important in the past, and the fact that we have fallen off of a cliff suggests that the market needs to bounce a bit in order to pick up enough momentum to fall over again. I do think that the NASDAQ 100 is a set of stocks that may do relatively well in this environment due to the fact that a lot of companies are starting to work remotely, thereby demanding technology-based products. Ultimately, this is a market that has been oversold though, and I think that the 7000 level should offer a bit of psychological and structural support based upon the last week, and the fact that we turned around to form a hammer is a very good sign that we should see at least an attempt to stabilize this market.

If we can break above the 7500 level, it’s likely that the market will then go looking towards the 8000 level next, perhaps even higher than that. I don’t have any interest in shorting until we break down below the bottom of the hammer, as it would show a capitulation of support, and could send this market much lower in a rapid fashion. That of course would be a massive breakout of support and could lead to the “capitulation” of the overall marketplace. At that point, it’s very likely that the market will eventually find a bottom as we usually see that type of move right before it happens. At this point, I’m not ready to buy this market, at least not until we break above the 8000 level. I do like the idea of looking for value eventually, as we should see plenty of gains eventually as the market recognizes that the world isn’t going to end. On a breakout above the 8000 level, if you do go long, you need to do so with little bits and pieces and try to build up to a larger position.