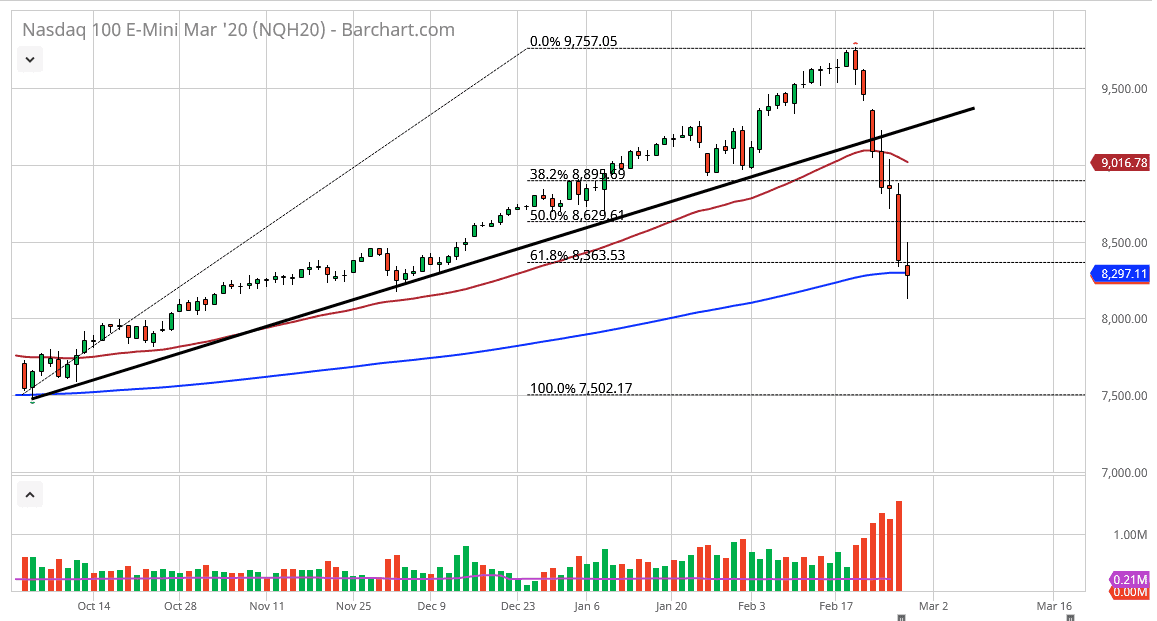

The NASDAQ 100 has been all over the place during the trading session on Friday, as we are sitting at the 200 day EMA. The market has rallied, pulled back, rallied, pulled back, and gone back and forth. In other words, the market doesn’t really know what to do but it should get more headlines to deal with over the weekend. The central banks around the world are almost certainly going to say something, and of course the coronavirus headline watch will still be out there. The candlestick for the day is a little bit more encouraging than some of the other ones, but it should be noted that a long legged doji has formed a couple of days ago as well, so therefore it doesn’t necessarily mean that the market is ready to bounce. Quite frankly, the market is going to make a binary decision, either breaking above the top of the range for the day on Friday or breaking down below it.

You should also keep in mind that there is a very good chance that there is some type of gap when we open up on Monday in the E-mini market, so you will probably have to buckle up. The smart thing to do is wait for the reaction on Monday at the open before putting money to work, or perhaps even waiting until the end of the day on Monday. It is worth noting that the 200 day EMA is sitting just below current price, and we are at roughly the 61.8% Fibonacci retracement level. All things being equal though, the market has a lot to think about and quite frankly it’s difficult to imagine a scenario where things will be easy.

I don’t think that the market is going to be able to go higher for a longer-term move right away, as the markets have so many different things to worry about right now. This is a market that has been oversold, but quite frankly the biggest problem right now is that it’s almost impossible to price in risk because we don’t know how the economies around the world are going to slow down. Furthermore, coronavirus cases continue to climb, so at this point it’s difficult to imagine any rally being anything more than an opportunity to sell at the first signs of exhaustion, and quite frankly I think that’s what most traders will be doing. Remember, a lot of traders have just got their heads handed to them and will be more than happy to get out as close to breakeven as possible.