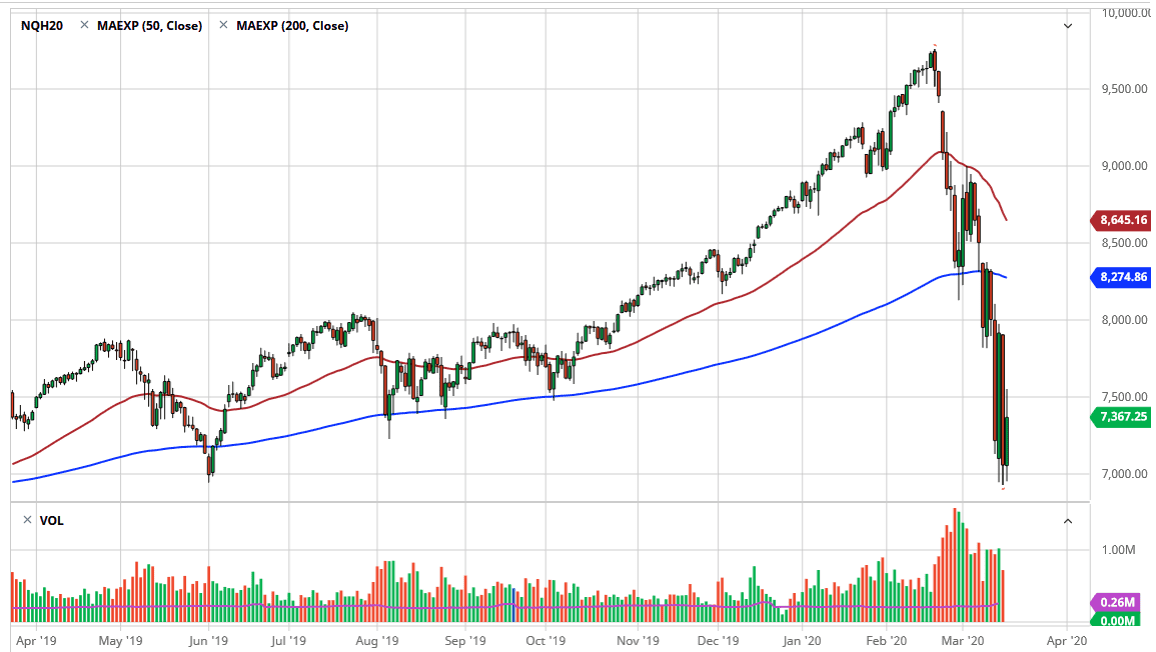

The NASDAQ 100 rallied a bit during the trading session on Tuesday, reaching towards the 7500 level. Looking at this chart, it appears that the 7000 level is trying to offer a significant amount of support, as it is a large, round, psychologically significant figure, and of course an area where we have seen buyer step in over the last several sessions. If the market was to find some type a bottom in this area, the longer it takes, the better off it will be as it shows a significant amount of thought into the idea of buying.

Looking at this market, if we were to break down below the lows of the last couple of days, it’s likely that the market goes looking towards the 6500 level rather quickly, and then eventually the 6000 level. Obviously, there has been a major shock to the system but quite frankly you can only sell off so much before you get a bounce. We have had a couple of short-term bounces, but I think we are going to have a more significant one going forward. The 7500 level did offer resistance during the trading session on Tuesday, so it’s a clear area to trade off up. If we can clear the highs from the Tuesday session, it’s likely that we go looking towards the 8000 level.

That being said, the Federal Reserve and the US government both are trying to do what they can to lift the markets, and one has to think that now that the officials are starting to panic a bit, it’s a sign that the markets can stabilize a bit. This is typically when longer-term traders start to put money to work, as a panic by officials means that a lot of help is coming. I believe that will be the same here but that doesn’t mean that it will be instantly. Ultimately, this will probably take quite some time, as so many people have been hurt by the sell off, and at this point it’s going to take quite a bit of time for traders to feel comfortable enough to put money to work. This market continues to be very noisy and difficult to trade, so at this point you need to keep your position size relatively small until we get a little bit more confident in the market, and as a result the next couple of days will be interesting to say the least.