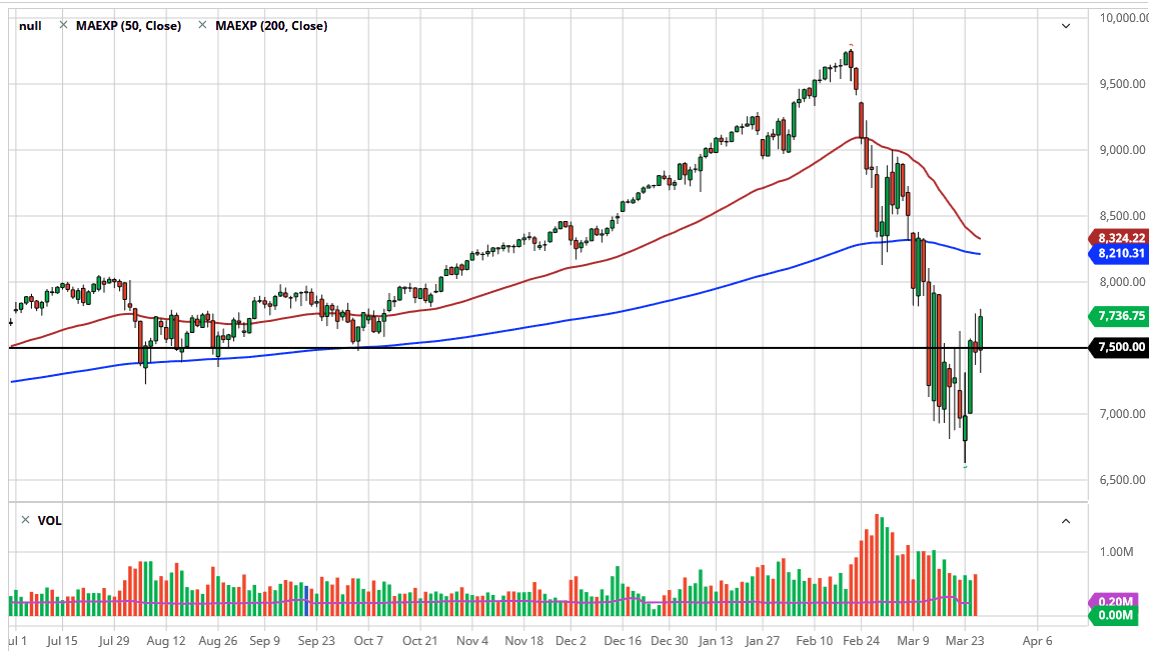

The NASDAQ 100 initially pulled back during the trading session on Thursday only to turn around and show signs of strength yet again. By breaking above the top of the shooting star from the Wednesday session, this suggests that the NASDAQ 100 is ready to go looking towards the 8000 handle again. That of course is a large, round, psychologically significant figure and an area that should attract quite a bit of attention.

At this point, signs of failure near the 8000 level should be looked at with suspicion, as there should be plenty of interest in that area. Beyond that, the 200 day EMA is sitting at the 8200 level so that should come into play as well. The question now is whether or not this has been a little bit of a relief rally or if it’s something more serious? The reality is that even though it’s been impressive of the last couple of days, there is still a long way to go in order to make up the losses. Quite often, you will see a retest of the lows in order to solidify the bottom. At this point, I don’t think we are quite done with negativity so don’t be surprised at all to see some type of flash crash to the downside. The 200 day EMA will of course cause quite a bit of resistance based upon technical analysis, and the fact that it has previously been both support and resistance as per usual.

I think we still need more stability when it comes to the coronavirus numbers, as they of course are a major influence on what happens in the stock markets. The NASDAQ 100 of course is more of a growth situation, as it is technically driven by technology growth. At this point, on simply looking to fade some type of rally that show signs of exhaustion. I also suspect that going into the weekend we may see some position squaring as people won’t want to carry all of this risk over the weekend quite often. With this, I don’t know that we have put in the absolute bottom, so I think a retest of that is coming. Can Friday be a bullish session? Of course it can. However, I think the next serious resistance barrier is above at the 8000 handle and will more than likely bring in fresh selling.