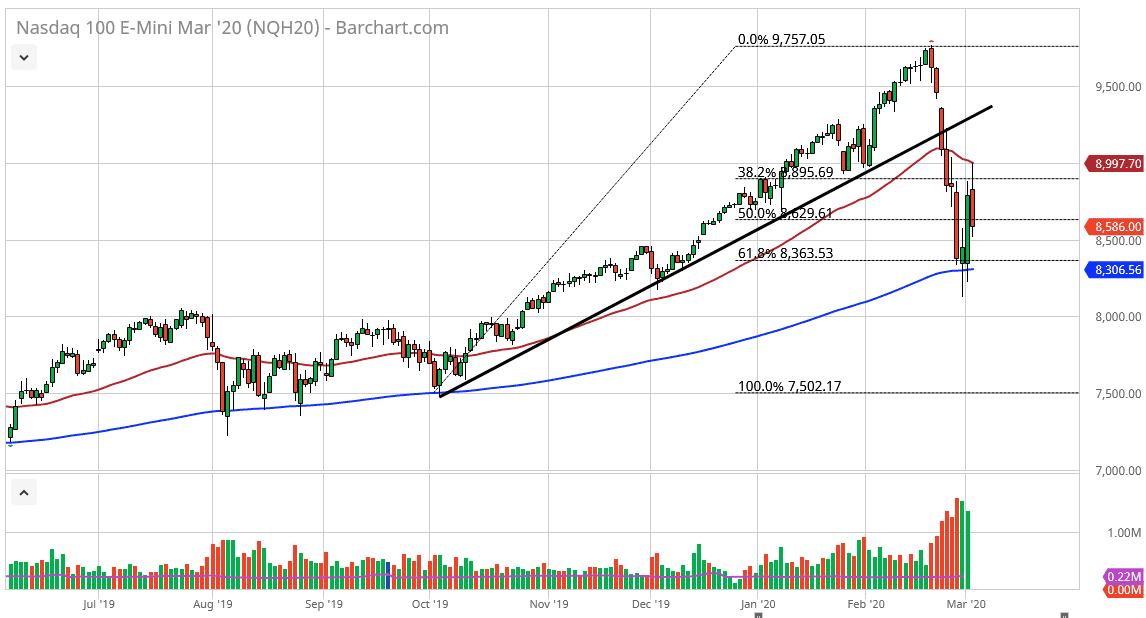

The Nasdaq markets initially tried to rally during the trading session on Tuesday, and it gained even more after the Federal Reserve came in and cut interest rates. However, that was short-lived and the 50 day EMA turned the market right back around. We continue to see a lot of volatility and ugliness when it comes to the markets. Ultimately, I think that we are going to go much lower, perhaps testing the 200 day EMA yet again.

If the market can’t rally on an interest rate cut, then one would have to wonder when that happens. I suspect it has something to do with the coronavirus, and it’s very unlikely that things are going to change anytime soon. I think that the market breaking down below the Friday candlestick should send this market to the downside in a very strong way, perhaps reaching down towards the 100% Fibonacci retracement level. That would mean a move down to the 7500 level underneath.

The alternate scenario is of course that we turn around and break above the top of the range for the trading session on Tuesday, which would be a very bullish sign indeed but I don’t think the market has it in there. This market will continue to trade on the latest fear headline, which seems to be almost unlimited. I’m a seller of rallies, and till the 50 day EMA is closed above on a daily candlestick, so at this point the quick synopsis is that there is nothing good to say about this market. Ultimately, I do think that the 8300 level offer support based upon the 200 day EMA but give it time, I’m almost positive we will break down the road. If I’m wrong, then it’s very likely that we get an explosive move to the upside but right now I’m not sure what we have out there to change things, so with that I’m very cautious but negative to say the least. The turnaround was quite drastic, and the fact that this was still a negative session, it doesn’t matter that the markets are higher than they were the day before, because it looks so horrible. All things being equal, I think at best you are looking at a choppy and sideways market. I am willing to bet that the market is going to start pricing in, yet another interest-rate cut.