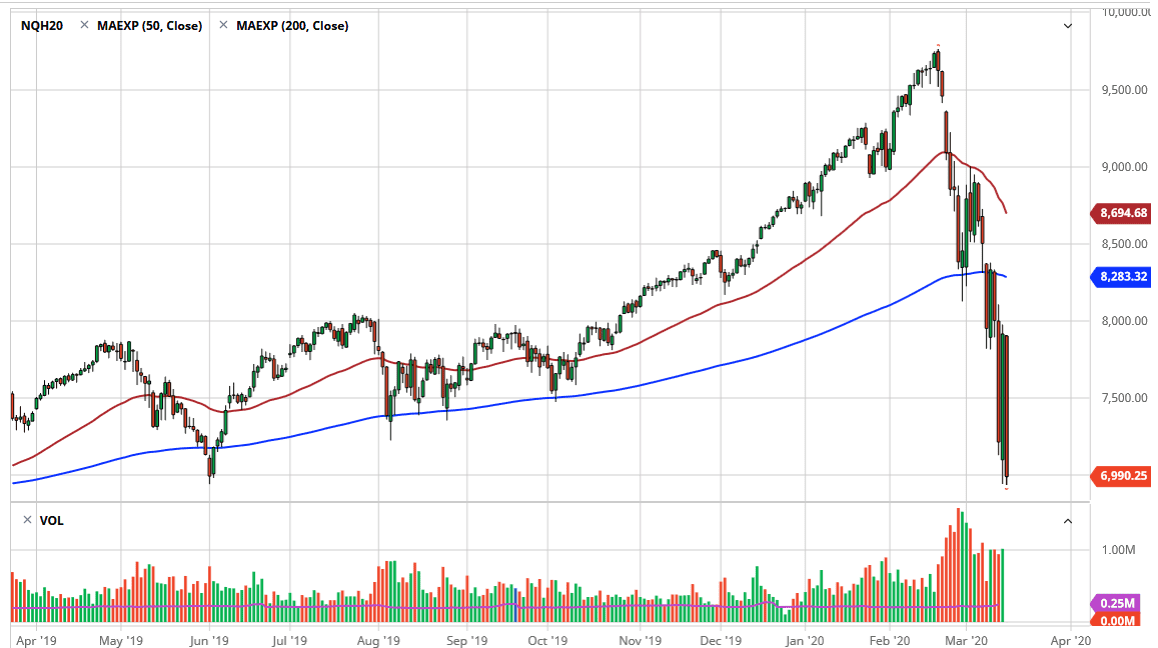

The NASDAQ 100 has gotten crushed again during the trading session on Monday, as the market sliced through the 7000 level to close just above it. It looks as if the 7000 level is going to give way, and as a result I believe that buyers will step in later, maybe not quite here. Having said that though, it does look like we could, on some type of bounce, try to form a range between 7000 on the bottom and 8000 on the top. I do not think that’s the likeliest of scenarios at this juncture though.

Once the market breaks down below the 7000 level, then the most obvious support level will be the 6000 level as it is the next large, round, psychologically significant handle. I think most likely what we are looking at is a scenario where we need to break down a little bit further to find people willing to step in and pick this market up. At this point, I believe that rallies will continue to be a “sell the rallies” type of situation.

The 8000 level above is going to be massive resistance, and I think going forward it will take quite a bit of effort to get above there. That being said though, I think that it’s very unlikely that the market can rally before the credit markets get back in line, something that they are nowhere near right now. Because of this, I like the idea of selling short-term rallies, and it should be noted that the VIX closed slightly above 80, which is the highest level it ever has, showing extreme volatility and concern.

The size of this bar is rather impressive, but it is starting to become relatively normal these days. I think it is going to take a certain amount of good news to finally rally for any significant move. It will be until the numbers of infection start to drop, and of course the right amount of bailouts for US companies happen. That still a bit of a moving target, so I think it’s only a matter of time before it does happen, but this market clearly has a lot of fear built into it and certainly favors the downside at the moment. I don’t have any interest in buying, but I prefer fading short-term rallies once they get a little stretched.