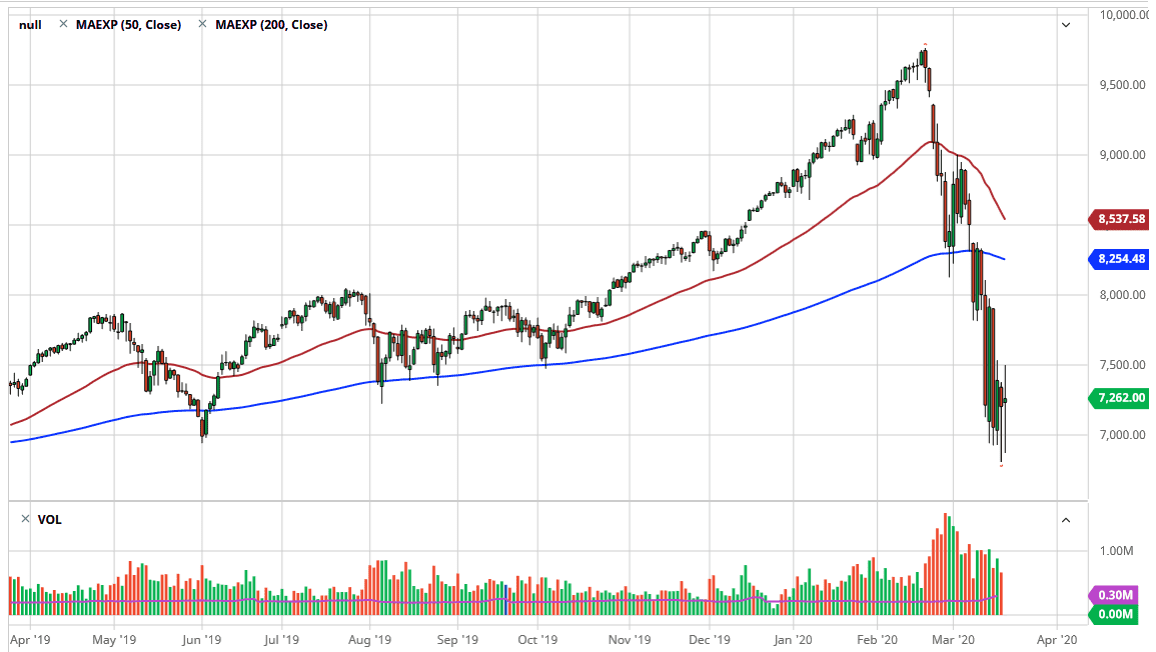

The NASDAQ 100 went back and forth during the trading session on Thursday, showing signs of stability yet again. Although this has been a very choppy week, when you look at the last four candlesticks it really hasn’t been as devastating as it feels, as the market continues to find a lot of interest near the 7000 level. At this point, the 7000 level looks to be very crucial, and as long as the market can stay above that level, it shows signs of perhaps trying to build up enough momentum to at least stop some of the selling.

Looking at this chart, it’s very likely that there are bargain hunters out there trying to take advantage of this significant fall, and of course the large, round, psychologically significant figure 7000 attract a lot of attention. If we can break above the 7500 level, that allows the market to rise as high as 8000 in a relatively short amount of time. One thing is for sure, the Friday session will be interesting because we could get a sudden move in one direction or the other, perhaps driven by short covering. Think of it this way: if you have been short of this market for a couple of weeks now, and have noticed that the last four sessions have been very stable all things considered, that’s a sign that it might be time to cover your shorts, thereby pushing the market higher.

Obviously, that doesn’t necessarily mean we have to rally but it now looks as if the low on Wednesday will be the trigger for more selling. If we were to break down below that level then I think it’s likely we go looking towards the 6500 level, possibly the 6000 level after that. You can see that this market is oversold by just about any metric that you use, but at the same time it was extraordinarily overbought. Perhaps part of the massive selling that we have seen has been due to the fact that people forgot that markets can move in different directions. I do believe that this will end up being a great buying opportunity, but you obviously need to be very cautious if you start to get into the market to the upside. Don’t be afraid to scratch a trade if it doesn’t work out for you, because once it does, it could be a very strong move. I suspect that 7500 is the key level to watch if you are trying to find value.