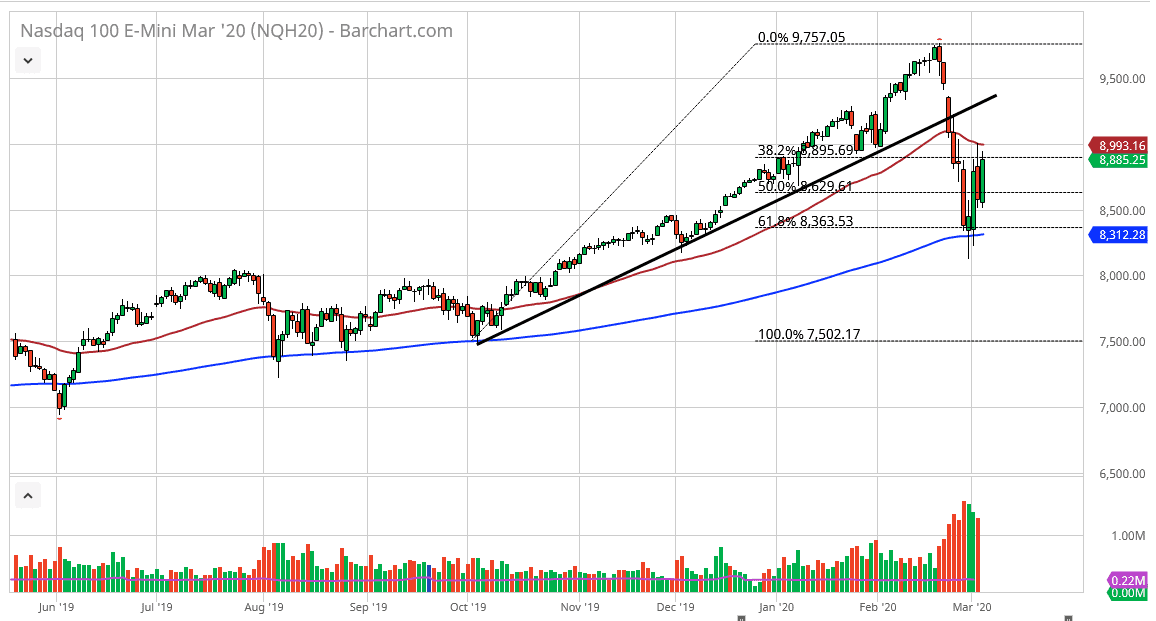

The NASDAQ 100 has rallied again during the trading session on Wednesday to take back the losses from the Tuesday session. We continue to chop around in this area, and at this point we are looking at a couple of major technical factors that could come into play. The most important technical factor would be the 9000 level, and if we can break above there it’s likely that the NASDAQ 100 will then go looking towards the 9250 handle. With the Federal Reserve cutting rates the way they have and the fact that they are being backed into a 50 basis point cut, that would be the default position. However, keep in mind that the 200 day EMA underneath should offer plenty of support, which is currently sitting at the 8312 level as well. In other words, if the market was to break down below there, then I think the bottom falls out and we go looking towards the 100% Fibonacci retracement level near the 7500 level.

Keep in mind that there has been a horrific selloff as of late, but this was very similar to the end of 2018 and most traders are hoping that is going to be the case. There is also a good chance that we get some type of stimulus coming out of various countries around the world, and that could help technology companies as well. Ultimately, if we can break above the 50 day EMA I think that would show a significant amount of momentum to the upside and we could go looking towards the gap lower that kicked this whole thing off just below the 9500 level.

That Is yet to be filled, which is typically does get done. If we can break above there, then the 9750 level would be targeted. After that, we would more than likely go looking towards the 10,000 handle. All things being equal, I think that it is only a matter of time before somebody tries to push this market to the upside, so I do like the idea of buying dips unless of course we get some type of horrific headlines coming out of Asia or the coronavirus situation. Looking at the candlestick for the trading session on Wednesday, it certainly looks as if we could get momentum to the upside as we had closed so well at the end of the day.