The NASDAQ 100 has been all over the place during the trading session on Monday, oscillating between gains and losses with the 7000 level being the fulcrum for price. We initially gapped lower, and then fell but this was based upon the idea that the Senate was not going to be able to pass a stimulus bill. That was turned around quite quickly, as it looks like they will eventually get things done.

Furthermore, the Federal Reserve has decided to step in and pick up the corporate bond market, an area that a lot of traders have been concerned about as of late. This is especially crucial to those companies in the NASDAQ 100 which are very sensitive to these situations as they tend to be younger companies that are highly levered in the debt market at times. That being said, keep in mind that the big players are the majority of this index, so it does insulate a bit from that situation.

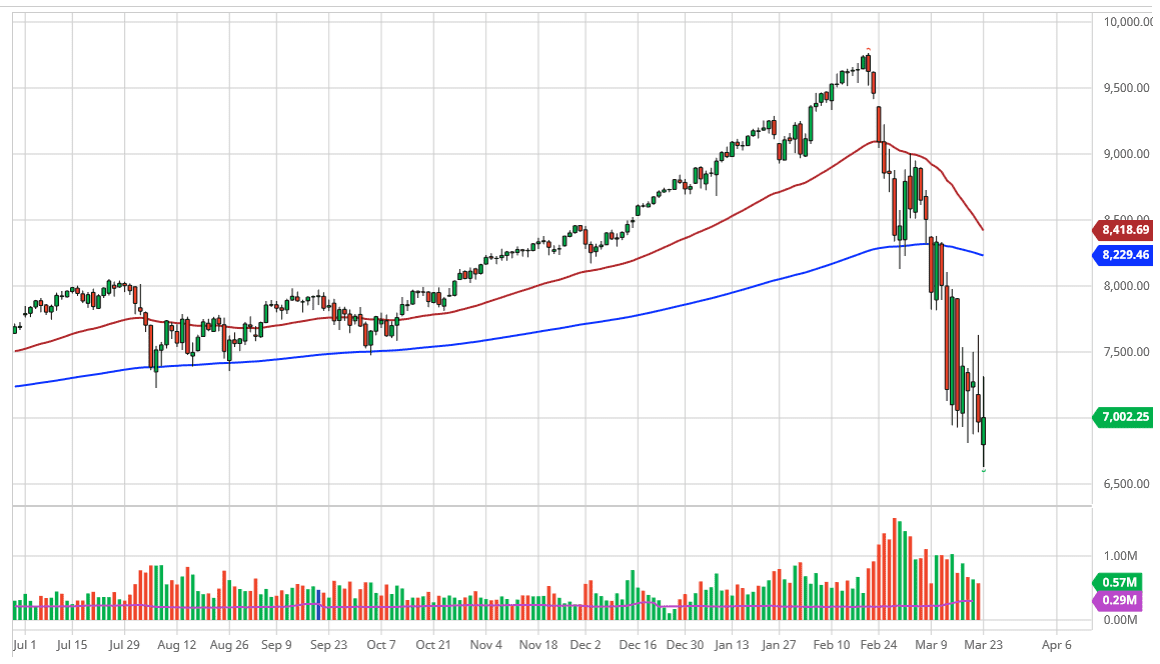

Looking at the technical analysis, you can see that we gapped lower, felt towards the 6600 level, and then turned around to explode to the upside before given back quite a bit of the gains. This wasn’t that impressive other than the fact that the market has had directional bias in multiple directions for once, so at least we are simply selling off in a complete panic. That’s the first sign of stabilization, and as a result there are some traders out there looking to get involved for a longer-term play.

All that being said, if we were to break down below the bottom of this candlestick it’s very likely that we will go looking towards the 6500 level, and then possibly even the 6000 level. Alternately, if we were to break above the top of the candlestick it would be a very bullish sign and could open up the door for an attempt to break above the 7500 level. Doing so would then open up the 7900 level. Having said all of that, this point I think the only thing you can count on is a lot of volatility. Quite often, when you have a massive breakdown like this you see a retest of the bottom, so I do think that although a rally may give you an opportunity to get long of the market for the short term, you need to take your profits quickly and start to look for a structural bottom in the form of a retest of the lows formed during the session, assuming that we do get a bounce.